We previously reported that ZTE’s Oliver Hu had suggested that NPEs have started to shift from the US to Germany and Asia. Recently, the CEO of patent pool and insurance provider RPX Marty Roberts also announced that the company is looking to expand into China. So how hospitable a market is China for patent troll activity?

Although there is a certain amount of difficulty in assessing which infringement lawsuits are from non-practicing entities in China, there are certain indicators, such as the judgments of invalidity proceedings, which can offer us insight into trends there.

In addition to invention patents (equivalent of US utility patent) which require a substantive examination, China has two kinds of patents which only need to go through a formalities examination to serve as the legal basis for patent enforcement suits, utility model patents and design patents. Although both have a shorter patent term (10 years), they can be an effective vehicle for protecting an invention with a relatively short lifespan.

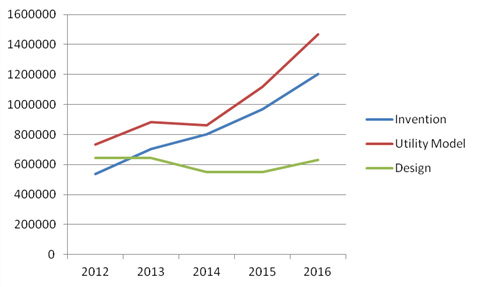

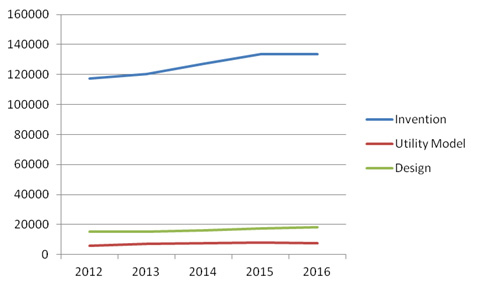

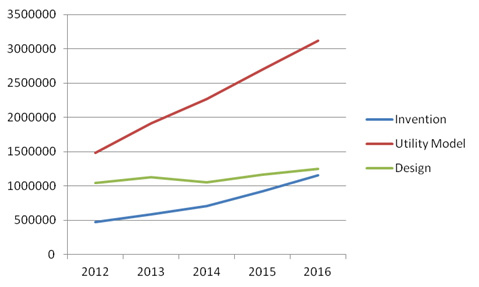

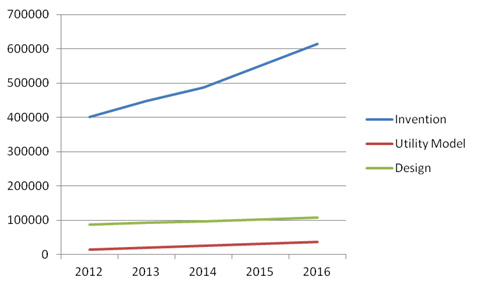

Domestic applications for utility model patents in China have outstripped both invention and design patent applications from 2012-2016, while foreign applicants have applied for more invention patents, followed by design, with utility model patents being the least popular (See Chart 1 and Chart 2).

Chart 1: Patent applications from domestic applicants received by SIPO from 2012-2016;

Source: SIPO Annual Patent Report; Compiled by Conor Stuart

Chart 2: Patent applications from foreign applicants received by SIPO from 2012-2016;

Source: SIPO Annual Patent Report; Compiled by Conor Stuart

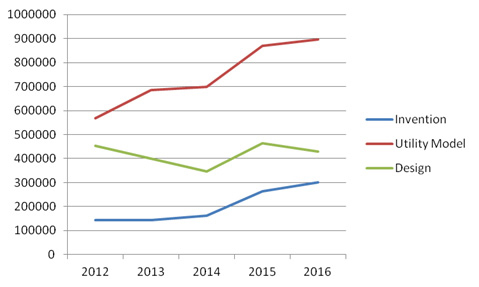

The same pattern is evident when it comes to patent grants in the country too, as the two classes of patent with only a formalities examination both have a larger share than invention patents among domestic applicants (See Chart 3).

Chart 3: Patents granted to domestic applicants by SIPO from 2012-2016;

Source: SIPO Annual Patent Report; Compiled by Conor Stuart

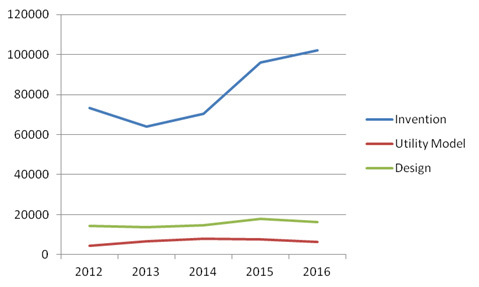

In terms of patent grants to foreign applicants, invention patent grants are by the far the most popular choice, followed by design and utility model patents (See Chart 4).

Chart 4: Patents granted to foreign applicants by SIPO from 2012-2016;

Source: SIPO Annual Patent Report; Compiled by Conor Stuart

This pattern is also echoed when it comes to patents in force from 2012-2016 (See Chart 5 and Chart 6).

Chart 5: Patents owned by domestic patentees in force from 2012-2016;

Source: SIPO Annual Patent Report; Compiled by Conor Stuart

Chart 6: Patents owned by domestic patentees in force from 2012-2016;

Source: SIPO Annual Patent Report; Compiled by Conor Stuart

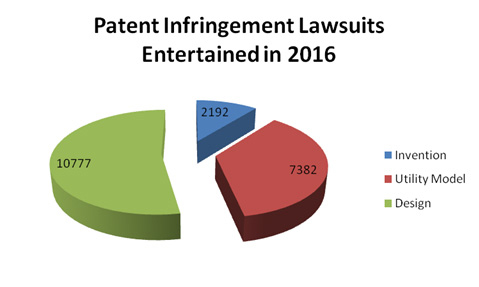

Design patents accounted the for the lion’s share of patent infringement suits entertained in 2016, accounting for 10,777 of a total of 20,351, followed by utility model infringement suits, numbering 7,382 and invention patent infringement suits with 2,192 (See Chart 7).

Chart 7: Patent Infringement Lawsuits Entertained in China in 2016;

Source: SIPO 2016 Patent Report; Collated by Conor Stuart

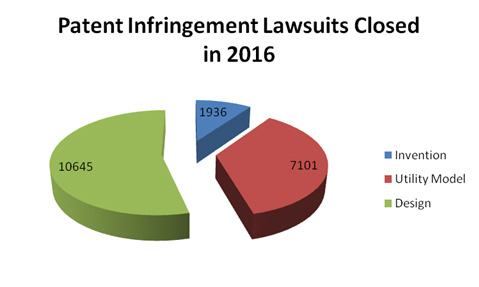

A similar patent can be seen in patent infringement suits which were closed in 2016 (See Chart 8).

Chart 8: Patent Infringement Lawsuits Closed in China in 2016;

Source: SIPO 2016 Patent Report; Collated by Conor Stuart

This doesn’t tell us an awful lot about how many of these lawsuits represent NPE activity, however. One indicator we can look at is invalidity proceedings, which provide a window into the use of low quality patents for patent infringement litigation. China does not have an institution procedure for invalidity cases and all applications are entertained.

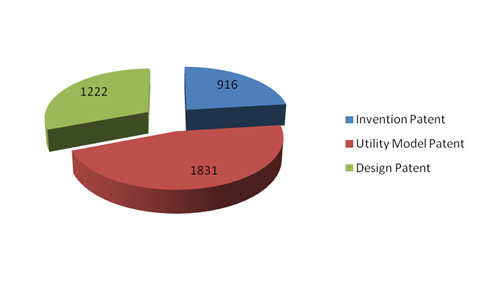

In 2016, there were 916 requests for invalidity proceedings against invention patents filed with SIPO’s Patent Re-examination Board, representing 23.1% of requests, along with 1,831 requests against utility model patents, representing 46.1% of requests and 1,222 requests against design patents, representing 30.8% (See Chart 9).

Chart 9: Invalidity Proceeding Requests Received in 2016 by each kind of patent;

Source: SIPO Report

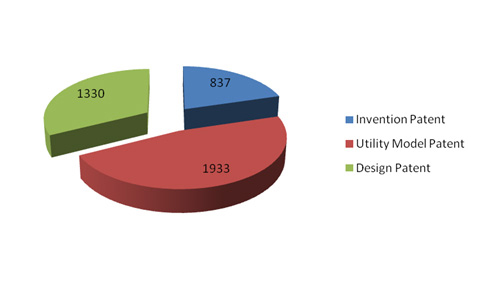

A similar pattern is seen with invalidity proceedings concluded in 2016 (See Chart 10). 1030 of these invalidity decisions were appealed.

Chart 10: Invalidity Proceeding Concluded in 2016 by each kind of patent;

Source: SIPO Report

Utility Model Patent

Definition: a utility model patent covers any new technical solution relating to the shape, the structure, or their combination, of a product, which is fit for practical use.

Term: 10 years from filing.

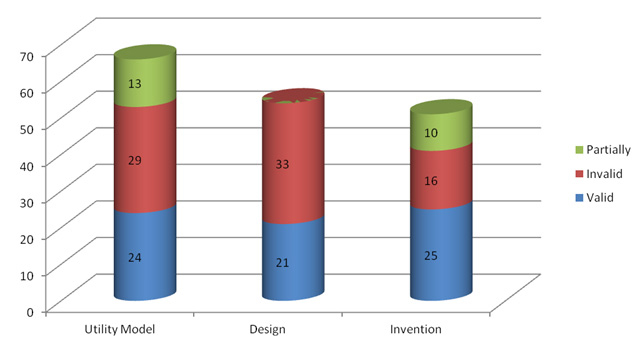

The fact that so many utility model patents have been challenged in invalidity proceedings suggest that these patents are being enforced. Looking at judgments made by the Patent Reexamination Board in October of this year, we can observe that of the 171 judgments handed down, almost 40% involved utility model patents, while design patents and invention patents accounted for just over 30% each (See Chart 11). 44% of utility model patents subject to invalidity proceedings were found invalid, compared to 61% of design patents and 31% of invention patents. 36% of utility model patents were found to be valid in full, while 20% were found valid in part; 39% of design patents were found to be valid, while 49% of invention patents were found to be valid in full and 20% were found valid in part.

Chart 11: Judgments by SIPO’s Patent Reexamination Board Handed Down in October;

Source: SIPO Patent Reexamination Board; Collated by Conor Stuart

It is perhaps not surprising that the proportion of utility model and design patents found to be invalid is higher than those found to be valid, given that they are subject only to formalities examination during the application process, but the fact that they are subject to invalidity proceedings at all suggests that there has been some attempt to monetize the patents. This suggests that utility model patents could be a useful vehicle for non-practicing entities in China.

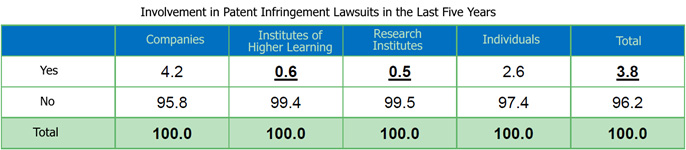

Table 1: Survey of involvement in patent infringement in China (%);

Source: 2016 China Patent Report; Translated by Conor Stuart

A recent survey conducted in China found that companies were the most likely to have been party to a patent infringement lawsuit, followed by individuals, then institutes of higher learning and finally research institutes, altogether comprising just 3.8% of the 8391 businesses, 470 institutes of higher learning, 346 research institutes and 602 individuals surveyed.

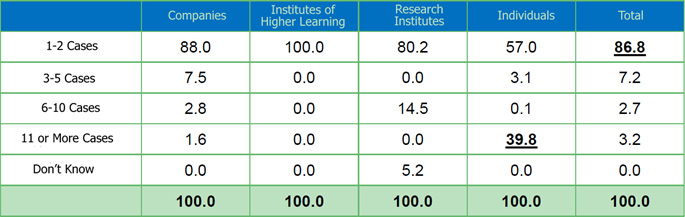

Table 2: No. of patent infringement cases (%) among companies, institutes of higher learning, research institutes and individuals which have been involved in patent infringement litigation over the past five years; Source: 2016 China Patent Report; Translated by Conor Stuart

Although the majority of entities (86.8%) surveyed reported only having encountered one or two patent cases, a significant percentage (39.8%) of individuals had been involved in 11 or more cases.

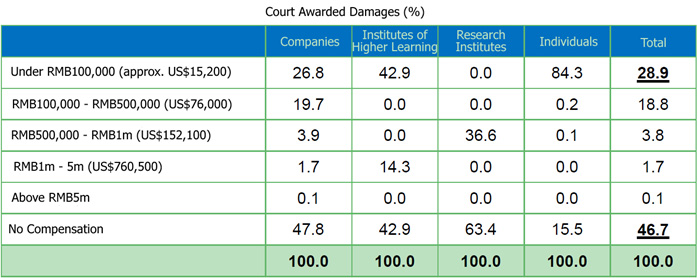

Barrier to Entry: Patent Damages

The meager damages awarded by Chinese courts in comparison to their US equivalents may stand in the way of NPEs flourishing in China, however. According to the survey referenced above, damages over RMB5 million (US$760,000) were awarded to just 0.1% of companies surveyed on their involvement in patent litigation over the five years preceding 2016 (See Table 3).

Table 3: Court awarded damages in patent infringement cases in China involving survey respondents from 2011-2015;

Source: China Patent Report 2016; Translated by Conor Stuart

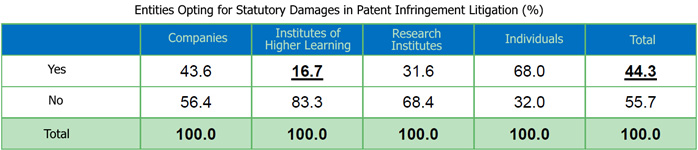

Median damages in patent infringement cases in the US in 2016 were US$6.1 million, according to a recent PricewaterhouseCoopers study. The highest damages awarded by a Chinese court in a patent infringement case was RMB$50 million (US$7.6 million), but this is an outlier. Part of the reason for this is that there is no discovery process in Chinese courts, so often it is hard to provide evidence of sales, which leads to many parties opting for statutory damages (See Table 4).

Table 4: Entities surveyed that opted for statutory damages in patent litigation in the five years preceding 2016;

Source China Patent Report 2016; Translated by Conor Stuart

Damages are gradually increasing, however, and litigation is speedier than in the US. It is also possible to get an injunction in advance of litigation, which can be used as an effective negotiating tool. So it remains to be seen whether more NPEs will move into China and with them patent pool solutions such as RPX.

Photo credit: Anagoria (Own work) [GFDL (http://www.gnu.org/copyleft/fdl.html) or CC BY 3.0 (http://creativecommons.org/licenses/by/3.0)], via Wikimedia Commons

|

|

| Author: |

Conor Stuart |

| Current Post: |

Senior Editor, IP Observer |

| Education: |

MA Taiwanese Literature, National Taiwan University

BA Chinese and Spanish, Leeds University, UK |

| Experience: |

Translator/Editor, Want China Times

Editor, Erenlai Magazine |

|

|

|

| Facebook |

|

Follow the IP Observer on our FB Page |

|

|

|

|

|

|