Hu Yi is the head intellectual property lawyer for Chinese communications company ZTE, as well as heading up the company’s intellectual property operations. He joined ZTE in March 2008, responsible for worldwide patent litigation. As the helmsman of ZTE’s intellectual property litigation and risk management, Hu Yi has made dozens of trips to the US and Europe, and has emerged successful from seven successive United States International Trade Commission section 337 investigations. Hu Yi stated that US non-practicing entities (NPEs), which are also commonly referred to as “patent trolls” have gradually begun to shift towards Europe, centering on Germany. In 2017 alone, ZTE has been accused of patent infringement in over 10 cases in Germany; at the same time many NPEs are gradually shifting to the Chinese market, which he expects will be the main battleground for NPEs in the next 3-5 years.

The Chinese National Federation of Industries (CNFI) recently invited Hu Yi to take part in a recent conference, ‘The Development of Patent Invalidity Proceedings and Patent Litigation in Mainland China and how Taiwanese Businesses Should Respond’. ZTE is headquartered in Shenzhen, but has operations worldwide. Hu Yi stated that ZTE manufactures communications systems and equipment, as well as end-user products. It sells its systems products worldwide, with China being one of its most important markets. Over 200 mobile telecommunications carriers are ZTE customers, and they are estimated to serve two thirds of users worldwide. In terms of end-user products, the US is ZTE's most important market for mobile phones, and sales there far outstrip those in China. It ranks in fourth place in the US market, behind its three biggest competitors there, Apple, Samsung and LG. As its biggest mobile phone market is overseas, ZTE has accumulated a lot of experience in overseas intellectual property litigation.

Hu Yi pictured at the conference; Photo by Tommy Tang

ZTE launched its overseas intellectual property strategy in earnest in 2015. Before 2010, they focused on developing the Chinese mobile phone market, but with increasingly fierce competition, ZTE decided to step beyond the Chinese market. Despite the company’s success in becoming a transnational corporation, with significant sales and profit in the US market, they’ve faced a large number of patent infringement suits, and have had no choice but to hand over large amounts in licensing fees. This demonstrates the importance of a global intellectual property portfolio for transnational corporations.

ZTE Global Patent Litigation

From 2009 to the present, ZTE have faced over 140 patent suits in the US alone, with 240 suits worldwide, including in China, the US, Germany, Norway, the Netherlands, India, France, the UK, Canada and Australia. The firm is currently involved in over 100 patent suits. After ZTE was listed in 2013 among the top 10 defendants in patent suits, it became a popular target for NPEs. With this external pressure, ZTE was forced into putting more into its intellectual property protection. Roughly 96% of suits launched against ZTE were filed by NPEs, according to Hu.

Hu Yi stated that global intellectual property litigation trends suggest that in the past few years NPEs have gradually gravitated towards Europe, focusing on Germany in particular, with ZTE already having faced 10 instances of patent litigation in Germany this year, all related to US-based NPEs; at the same time, more and more NPEs are filing suit in China, he said, adding that he predicts China will become a major battleground for patent litigation in the next three to five years. Hu Yi shared his experience of patent litigation in China, the US and Germany and compared the nature of litigation in each country.

Litigation in China, the US and Germany

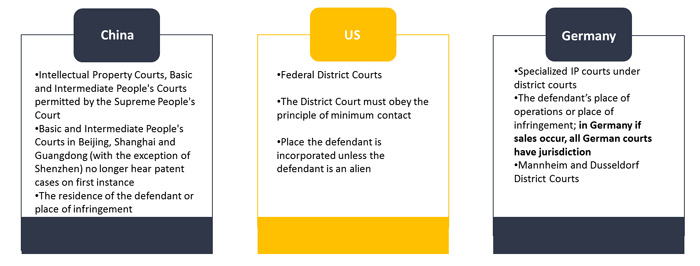

Jurisdiction

Intellectual property protection has become more and more important in China, with especially dramatic changes over the last two years, with China establishing dedicated IP courts with jurisdiction over intellectual property litigation.

A recent US Supreme Court decision in TC Heartland v. Kraft Food Group is set to limit the success of NPEs in litigation in the US by preventing litigants from suing in plaintiff-friendly courts such as the Eastern District of Texas, reversing the Federal Circuit. It did so by narrowing the choice of venue to the place where a defendant resides or where they have infringed and have a regular and established place of business, as stated in 28 US Code § 1400, where previously this had been supplemented with a broader interpretation on venue generally, which allowed a suit to be filed in any district where infringement had occurred, whether or not the defendant was resident there. Things are not likely to change for foreign defendants who are incorporated outside the US, however, according to partner at Orrick, Herrington & Sutcliffe, Robert Benson, citing the Supreme Court ruling in Brunette Machine Works v. Kockum Indus. which states that aliens may be sued in any district, subject to personal jurisdiction.

This will likely hasten the migration of patent infringement litigation by NPEs from the US to Europe and China.

In Germany district courts have established special IP courts, and the majority of IP litigation is concentrated in the district courts of Mannheim, Dusseldorf and Munich. Hu Yi stated that there are a lot of high-tech companies in Dusseldorf, which can more easily lead to disputes. This means that the Dusseldorf court is more experienced in this kind of litigation; the Mannheim district court has become a popular venue for patent litigation because of the high level of success there for patent holders; whereas Munich has the unique advantage of being the seat of the European Patent Office (EPO).

Hu Yi stated that in terms of jurisdictional issues, China has more potential compared with the US and Germany where cases are heard by district courts on first instance. Most patent litigation cases in China are heard at the dedicated intellectual property courts (equivalent to Intermediate People’s Courts) or Intermediate People’s Courts on first instance, which are higher ranking and more specialized courts. Hu Yi said that the only issues yet to be resolved are those of the amount of damages normally awarded by courts and the reasons for the grant of injunctions and then, he said, China will attract a lot of rights holders and NPEs to file suit there.

Figure 1: Source: Hu Yi's presentation at the conference; translated and adapted (in light of TC Heartland case outcome) by Conor Stuart

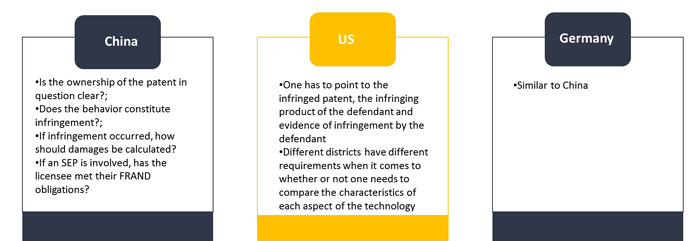

Requirements for Filing

China and Germany are similar in terms of the requirements for filing a lawsuit and both countries have clearer legislation than the US. In the US one has to point to the infringed patent, the infringing product of the defendant and evidence of infringement by the defendant; however different districts have different requirements when it comes to whether or not one needs to compare the characteristics of each aspect of the technology. In China, one has to be sure of the following aspects: the ownership of the patent in question should be clear; does the behavior constitute infringement; if it constitutes infringement, how should damages be calculated; if it’s an SEP, it must be established if the licensee has met their FRAND commitment.

Figure 2: Source: Hu Yi's presentation at the conference; translated by Conor Stuart

Evidence

The rules pertaining to evidence in Chinese patent litigation are similar to those in Germany, in that the burden of proof lies on the plaintiff. Compared to the US discovery process, China’s evidence process is relatively simple. The difficulty for the patent holder in Chinese patent litigation is in proving damages. This also explains why there are so many instances of statutory damages being awarded in Chinese patent litigation.

Figure 3: Source: Hu Yi's presentation at the conference; translated by Conor Stuart

Time

The length of proceedings can be said to be the biggest strength of Chinese patent litigation, compared to the US and Germany, as China has national limits on the amount of deliberation time, and so patent litigation takes less time and the conclusion rate is higher. China's Intellectual Property Courts in Beijing Shanghai and Guangzhou, for example, take an average of 186 days, 196 days and 97 days to conclude a patent litigation case; whereas when a case reaches the hearing stage in US courts, it takes an average of 2.5 years to conclude; In Germany it takes an average of 0.75-1 year, and if a case is appealed, it normally takes 1-1.25 years, and Supreme Court judgments can take 1.5-4 years. So there is a big difference between the three countries.

Figure 4: Source: Hu Yi's presentation at the conference; translated by Conor Stuart

Remedy

Although cases are heard at a fast pace in China, compared to the US and Germany, damages are lower in China, and statutory damage are adopted with more frequency. There is also a high bar for injunctions in Chinese patent litigation, with only a small minority of cases seeing the granting of an injunction. However, from recent trends in damages and legislation, the amount of damages awarded in patent litigation cases in China has been gradually rising, not only with punitive damages but also with a relaxing of the standards for injunctions.

Cost

Compared to the cost of litigation in the US, the cost in both China and Germany is lower. US patent litigation is charged depending on the stage, and the attorney fees are considerable. The attorney fees for an average case in the US costs US$1-1.5 million; In Germany attorney fees and official fees for the case at first instance cost around €200,000 (US$223,700). Overall Chinese court proceedings are more specialized, the litigation process is simpler, more efficient and less costly, while providing evidence is relatively easy; but damages are lower and injunctions are harder to come by.

Play to your strengths

Hu Yi stated that when dealing with patent litigation, even if the patent suit is not being heard in China, there are certain tactics that can be adopted in China which may lead to a desired outcome by putting pressure on the other party.

Plaintiff |

Corresponding Strategy |

SEP Licensor |

- ✔Investigate if the licensor has met their FRAND obligations and if they have violated anti-monopoly laws. If the licensor has not met its obligations or has violated the law, you can launch an anti-monopoly suit or a suit to decide a licensing fee.

|

Practicing Entity |

- ✔File patent infringement litigation in China or an administrative investigation in order to affect the reputation and market of the other party. You can also prevent the other party from manufacturing its product in China through an injunction on exports.

- ✔Start to work on invalidating the patent both overseas and its related patent in China, or on other important patents held by the other party.

|

NPE |

- ✔Start to work on invalidating the patent both overseas and its related patent in China, or on other important patents held by the other party.

|

Source: Hu Yi's presentation at the conference; translated by Conor Stuart

|

|

| Author: |

Conor Stuart |

| Current Post: |

Senior Editor, IP Observer |

| Education: |

MA Taiwanese Literature, National Taiwan University

BA Chinese and Spanish, Leeds University, UK |

| Experience: |

Translator/Editor, Want China Times

Editor, Erenlai Magazine |

|

|

|

| Facebook |

|

Follow the IP Observer on our FB Page |

|

|

|

|

|

|