|

Figure 1: Source: Tech in Asia; Creative Commons License

On Jan. 31, 2018, Taiwan’s Presidential Office announced the FinTech Development and Innovation Experiment Statute (FinTech Sandbox Statute), and announced that it would be implemented within three months. The Financial Supervisory Commission (FSC) has subsequently drawn up three draft guidelines, The Management of FinTech Innovation Experiments, the SOP of Examination and Appraisal Meetings on FinTech Innovation Experiments, and Working Guidelines for how Fees Should be Calculated in Civil Disputes over FinTech Innovation Experiments and are seeking public opinion on the three drafts for a period of 30 days. The statute is expected to enter into effect on April 30, and applicants can apply to the FSC for inclusion in the scheme from May, and should be able to start their pilot schemes in the third quarter of this year at the soonest.

Proposals for pilot schemes will be subject to the scrutiny of an examination committee convoked by the FSC, and a decision will be made on the proposal within 60 days of application.

Details of the Taiwanese Sandbox

Applicants and Proposal

The Taiwanese sandbox is aimed at increasing access, usage and quality. Natural persons, wholly-owned or jointly-owned enterprises and corporations can apply, as long as they provide evidence of business license (enterprises and corporations) and proof of residence in the Republic of China (Taiwan) or proof their agent resides in Taiwan. Applicants must state where their funds are coming from.

The proposal itself should be structured as follows:

- The financial services experiment that the applicant wishes to undertake and the financial regulations and laws it involves, including any laws or regulations they are seeking exemption from or an adjustment to.

- An explanation of what is innovative about the experiment.

- Details on the scale and length of the experiment and the number of participants to be involved.

- Measures taken to protect those who will take part in the experiment.

- Risk management systems.

- Expected efficiency and basis for measuring efficiency.

- An exit strategy in the event that the applicant wishes to end the experiment or the FSC revokes or cancels approval for the experiment.

- A risk management analysis assessing the possible risks of money laundering and the funding of terrorists and measures designed to manage these risks.

- Those applicants holding FinTech patents should attach information on them.

Those running experiments in the sandbox must also promise to give priority to launching services in Taiwan and give details of information systems to be used in the experiment and the names of those responsible for managing the experiment and other documentation required by other regulatory authorities.

Examination

The FSC will hold examination panels to assess applications and the results of experiments. This panel should be made up of members of organizations with expertise in the financial services field together with experts from other fields and should comprise 7-21 people and should be headed up by an official at vice-ministerial level or above. External examiners--industry experts or scholars--should make up no more than half the committee, but must not be less than one third. At least half examiners must be present for an examination meeting to proceed, resolutions must be passed with the support of two thirds of the members.

The panel will examine proposals using the following criteria:

- Does the experiment involve financial services that require authorization from the FSC?

- Is the experiment innovative?

- Does the experiment have the potential to raise the efficiency of financial services, reduce manpower and lower costs or provide added benefits to consumers and businesses?

- Has a risk analysis been carried out and have measures been put in place to manage these risks?

- Are measures in place to protect those taking part in the experiment, including providing suitable compensation?

- How many people will take part in the experiment and what is the transaction limit?

- Other items.

The FSC should complete the examination of an application 60 days after receiving it and notify the applicant of the result. If the application involves any other regulatory agencies, the FSC should seek their opinion before issuing a response.

In line with the third criterion, experiments must not be similar or identical to those already approved by the FSC examination panel. Neither can they have been published by domestic financial services providers or implement patented technology or methods of others.

Experiment

Experiments are limited to a six month maximum, although this can be extended once with permission from the FSC, and the maximum possible extension is an additional six months. Applicants must provide a valid reason for an extension and evidence of the efficiency shown in the experiment to the FSC one month before the end of the original term of the experiment. The FSC must approve or deny the extension within the term of the original experiment and inform the applicant of the decision in writing.

Successful applicants should commence their experiment within three months of receiving notice of their successful proposal and notify the FSC within five working days that the experiment has commenced. If applicants fail to commence their experiment within the three month deadline, their authorization will be revoked.

The party carrying out the experiment should ensure that adequate measures are in place to protect information during the course of the experiment. They are also required to adhere to the regulations laid out by the FSC and respond to any requests for information on the progress of the experiment. They should not obstruct or refuse any request from the FSC for a field inspection. If they are found not be adhering to regulation, they will be given a deadline to show improvement.

In any of the following circumstances, the FSC will revoke authorization for the experiment:

- If the experiment has a dramatic negative impact on the financial market or on the rights of consumers.

- If the scale of the experiment expands beyond that approved by the FSC.

- If the party carrying out the experiment does not adhere to the regulations as laid out by the FSC and fails to make improvements before the deadline for improvement expires.

The experimenter should not change the main point of the experiment, but can make smaller changes to the experiment with permission from the FSC examination panel.

Any contracts for financial products or services between the experimenter and all of the participants in the experiment should have a roof of NT$100 million (US$3.4 million) in terms of transaction value, funds or exposure, or the equivalent amount in foreign currency.

With the exception of professional investment institutions, experimenters are limited to providing products or services to individual participants, in terms of funds, transactions or exposure, as follows:

- Consumer Credit is limited to a sum of NT$500,000 (US$17,160).

- Premiums for insurance products or insurance services charges limited to NT$100,000 (US$3,430) or the equivalent in foreign currency or insurance coverage totaling NT$1 million (US$ 34,280) or its equivalent in foreign currency.

- For other financial products or services the limit is set at NT$250,000 (US$8580) or its equivalent in foreign currency.

If the experimenter is simply collecting service fees from participants, the amount of fees should be submitted to the FSC panel for authorization. The limits can be relaxed or further limited by the examination panel on a case by case basis, depending on the kind of services involved.

Experiments must include participants

Post-Experiment Review

Within a month after the experiment is complete, the party who carried out the experiment should submit a report to the FSC on the results of the experiment, along with confirmation of adherence to regulations concerning consumer protection measures and data privacy. This report will then be examined by a panel convened by the FSC. The FSC panel should complete the examination within 60 days of receiving the report, consulting with the party that carried out the experiment when necessary, and notify the experimenter and other regulatory authorities of the result. The result of this examination has no legal effect and is just for reference. The FSC should publish the results of the experiment within three months of the end of the financial year, taking measures to protect the experimenter’s trade secrets.

If the experiment is innovative and shows a significant boost to the efficiency of financial services, lowering manpower needs or costs, or provides benefits to consumers and industry, the FSC should deliberate on whether to revise financial regulations on the basis of the experiment and should refer the experimenter to the relevant government body or foundation to give them guidance on starting their business.

After the FSC review of the experiment, the experimenter can apply to engage in the business operations relating to the experiment, but must conform to financial regulations and laws. If the FSC decides to make adjustments to regulations, when necessary they should provide a transitional period.

Sandbox Counterparts

1) UK

The idea of a regulatory sandbox for FinTech was first proposed by the UK’s Financial Conduct Authority (FCA) in 2015 and was launched in June 2016. So far the sandbox has supported over 60 firms in three cohorts. The deadline for application for the fourth cohort has already passed. The UK project, part of a larger program called Innovate, is designed to allow firms to test innovative products, services and business models on a limited group of consumers, with safeguards in place. The FCA published a paper in October 2017 on the lessons learned so far during the sandbox. Each cohort period lasts six months and firms have to meet the eligibility criteria ((i) carrying out or supporting financial services business in the UK (ii) genuinely innovative (iii) identifiable consumer benefit (iv) need for sandbox testing (v) ready to test). The firms are offered (i) restricted authorisation (ii) rule waivers (iii) individual guidance (iv) no enforcement action letters.)

70% of firms in the first cohort successfully completed testing, 90% of firms that completed testing, are bringing the product towards a wider market. The UK sandbox also provides a fast track to authorization for restricted financial services for non-authorized firms. 40% of firms in the first cohort received funding after successfully completing testing. There were 146 applications for the first two cohorts, 50 were accepted and 41 tested.

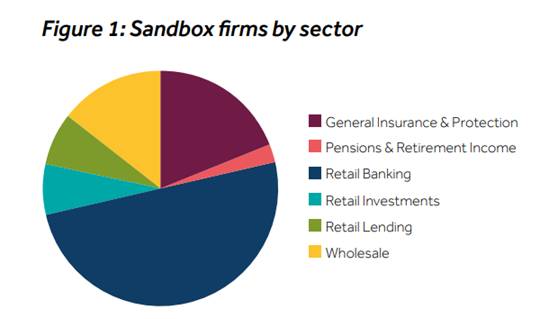

UK sandbox first two cohorts by industry; Source: UK FCA Regulatory Sandbox Lessons Learned Report

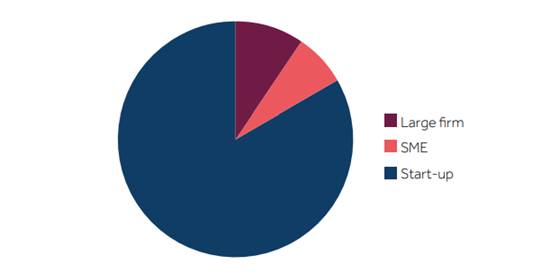

UK kinds of firms in first two cohorts; Source: UK FCA Regulatory Sandbox Lessons Learned Report

Use of technology was central to the examination standards when appraising proposals. Distributed ledger technology was the most popular technology featured in the first two cohorts, with 17 firms.

The FCA have recently announced a decision to offer sandbox services globally.

2) Others

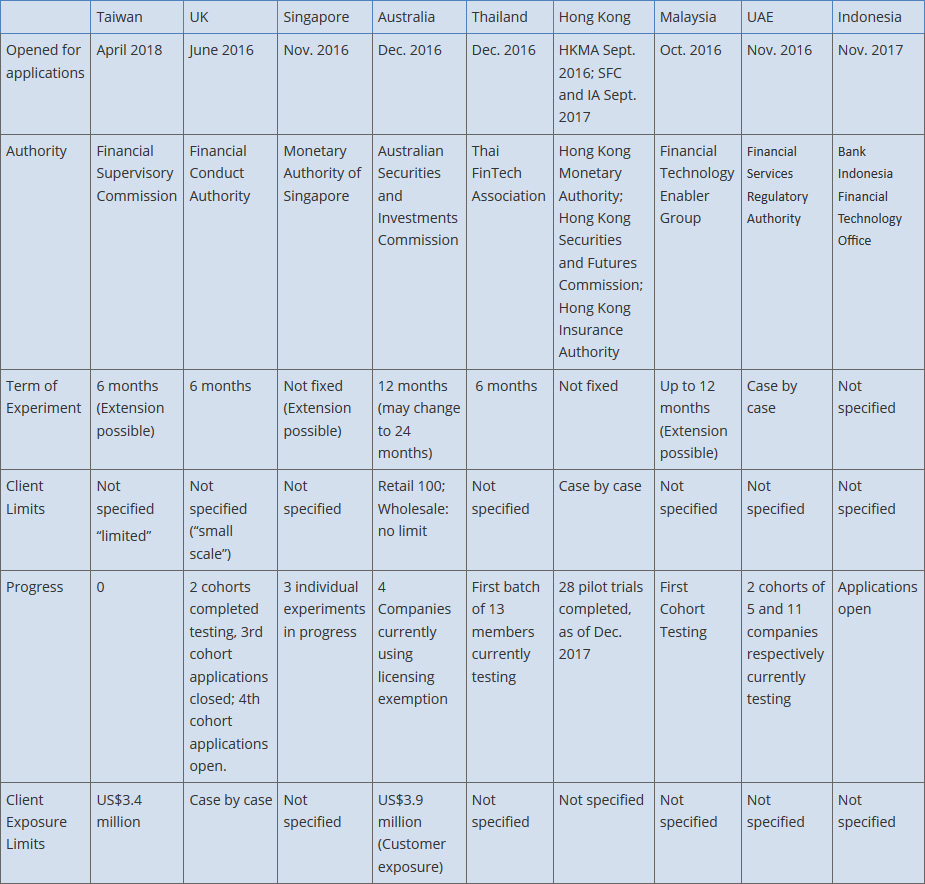

FinTech regulatory sandboxes have since been launched in Hong Kong (three separate sandboxes run by the Hong Kong Monetary Authority, the Hong Kong Securities and Futures Commission and the Hong Kong Insurance Authority), Singapore, Australia, Thailand, Indonesia, the United Arab Emirates and Malaysia. The table below compares the different projects. Not all of the sandboxes are open to firms without authorization for restricted financial services, whereas the UK sandbox is seen as a route to being authorized. Arizona became the first US state to create a FinTech regulatory sandbox when it signed the bill into law earlier in March, it is expected to start taking applications at some point in 2018.

References:

https://www.fca.org.uk/publication/research-and-data/regulatory-sandbox-lessons-learned-report.pdf

|

|

| Author: |

Conor Stuart |

| Current Post: |

Senior Editor, IP Observer |

| Education: |

MA Taiwanese Literature, National Taiwan University

BA Chinese and Spanish, Leeds University, UK |

| Experience: |

Translator/Editor, Want China Times

Editor, Erenlai Magazine |

|

|

|

| Facebook |

|

Follow the IP Observer on our FB Page |

|

|

|

|

|

|