|

Figure 1: The speakers at the conference assemble for a group photo; Source: Conor Stuart

Taiwan has set its sights on playing a major role in the artificial intelligence (AI) global supply chain, and it may be making headway with help from international corporations, as suggested by the recently announced agreement between US tech giant NVIDIA and Taiwan’s Ministry of Science and Technology which will see an AI-focused supercomputer built at the National Center for High-Performance Computing.

AI+ technologies were the theme of a recent conference held by the Chung-Hua Institution for Economic Research (CIER). In his introductory speech at the conference CIER president Chung-Shu Wu stated that recent years have seen the rise of big data, cloud storage, programming and Internet of Things (IoT) technology, amongst other innovative technologies, which have contributed to breakthroughs in development across many industrial fields.

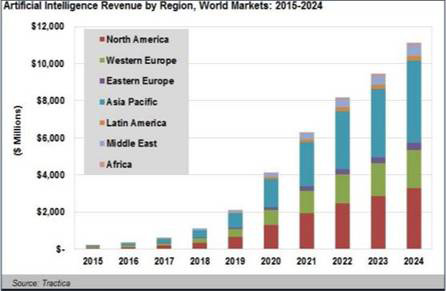

Wu stated that 2017 has proven to be already in the era of the connectivity of all things, with AI making up one of ten major trends. Citing a report from an unspecified international research organization, he stated that global business opportunities from AI technology are expected to rise from US$30 billion in 2016 to US$300 billion by 2020, which would be ten-fold growth in just four years. He pointed to the fact that global tech giants, including Google, Facebook, Amazon, IBM and Microsoft have not only been actively investing in the AI field, but have also laid the groundwork for the AI field in 2016 with financing and investments and acquisitions.

Figure 2: Artificial Intelligence Revenue by Region, World Markets: 2015-2024; Source: Tractica, cited by Ministry of Economic Affairs.

He cited the three objectives listed by Taiwanese president Tsai Ing-wen – innovation, employment and distribution of wealth – and her hopes that technological innovation can stimulate the employment market, with fair distribution of wealth as the ultimate goal. He stated that Taiwan, like other countries around the world is actively creating policies in order to facilitate smart technology, industrial innovation and the digital economy.

He pointed to communications, electronics, healthcare and medical care and manufacturing as the likely applications of AI+ technology. He added that Taiwan’s existing strengths in mechanical manufacturing would be a big opportunity for the future in terms of industrial transformation, particularly for Taiwanese OEM manufacturers.

Zse-Hong Tsai, executive secretary of the Board of Science and Technology of the Executive Yuan stated that the government shouldn’t be the largest player in AI+ technologies and that innovation should be led by industry. He added however, that the government has to ensure that its policies are not creating issues for industry that make innovation impossible and that smart technology development is in line with the government’s industry policy.

Companies that compete in terms of digital innovation will likely be able to succeed across a range of different fields, said Tsai. The changes in infrastructure as part of the digital revolution have reshaped industry and how business models function, he added. He also said that Taiwan needs to shift its viewpoint, moving from thinking of ICT solutions as a cost-cutting tool to seeing it as a route to innovation.

He listed increasing competition for ICT talent, increased demand for broadband infrastructure, and free data flow as priority considerations.

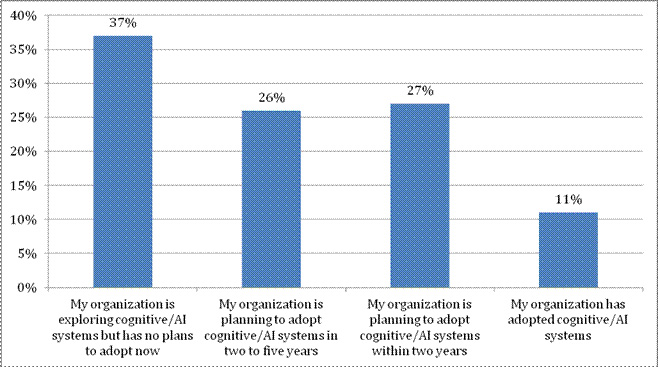

Chwee Kan Chua, VP of IDC Asia Pacific’s big data analytics and cognitive/AI computing practice, also spoke at the conference, and gave a larger picture of AI development in the Asia Pacific region as a whole. Only 11% of organizations in the Asia Pacific excluding Japan (APeJ) have adopted cognitive/AI systems, compared to a rate of 38% in the US and around 10% in Western Europe, according to an IDC survey cited by Chwee (see Figure 1).

Figure 1: The answers given by surveyed organizations in the Asia Pacific excluding Japan on their status regarding cognitive/AI systems; Source: IDC Asia Pacific Cognitive AI Adoption Survey 2017, in Chwee Kan Chua’s presentation

A further 53% plan to adopt the technology within two years, while 37% don’t have plans to adopt it.

Among the APeJ organizations surveyed in the IDC report Chwee cited, 44% of those in the financial services industry were in the top three stages of information DX stage, compared to 40% in the manufacturing sector, 39% in the communications and media industry and just 29% in the healthcare and life sciences sector and 19% in the public sector.

59% of organizations surveyed plan to make new software investments for cognitive/AI, whereas 45% will make new investments on hardware, IT services and business services. Data services were the lowest ranked with 43%, according to the report cited by Chwee.

The top three countries with the highest percentage of organizations investing more than US$1 million in cognitive/AI annually are Australia, New Zealand and Thailand, whereas Taiwan ranked in sixth place in this category. 15% of APeJ organizations plan to spend over US$1 million on cognitive/AI, whereas 40% aren’t planning to spend on the technology field.

The main expected benefits of adopting cognitive/AI solutions are increased employee productivity and increased product automation, according to the report.

In terms of barriers inhibiting deployment of cognitive/AI systems in businesses surveyed in the APeJ, only 7.7% responded that their data problems were too severe, which was listed after lack of skill sets and understanding of vendors solutions, governance and regulatory implications at 35.1%, problem with stakeholder buy in at 31.7% and cost of solution at 25.5%. Chwee pointed out that many companies only become aware of how problematic data can be once they actually start to try and implement AI solutions, which is reflected in the heightened consciousness of data problems in Australia and New Zealand, which both listed it as the primary inhibiting factor. The first step in this process is the ability to produce clean datasets to feed into AI or to analyze with big data technology.

When the topic of AI in the medical sector comes up at conferences in Taiwan, officials often take the opportunity to mention the great dataset compiled by the National Health Insurance Administration, which will give Taiwan a running start in terms of the application of AI in this sector. Yun-Peng Chu, professor of the College of Management at Taipei Medical University drew attention to the fact, however, that much of this information is collected for the purpose of insurance and so it is geared around costs rather than specific records of test results and analysis. In this respect, Taiwan is still lagging behind neighbours in the region, like Japan, which already shares medical information between different hospitals and even among communities. The National Health Insurance dataset is also highly restricted in terms of access, according to Chu, and applicants are subject to a committee review before being granted access, so businesses in Taiwan might not be in the ideal position to exploit this dataset.

There has been some progress in this regard, however. Taiwan has been pushing for the expansion of the use of Electronic Medical Records that can be used across different hospitals since 2004, as part of its Health Informatics Project. As of December 2014, 321 of Taiwan’s 501 hospitals and 20,000 clinics were taking part in inter-institution EMR exchange[1]. In Japan, as of 2014, 2142 hospitals in Japan were using EMR systems, with the Fujitsu system accounting for a 33% share of the market, according to Koki Akahori, senior manager of Solutions Development Department I in Fujitsu’s Healthcare Solutions Unit II. These EMR systems are linked into regional medical networks using the HumanBridge network, on which medical images can also be viewed.

Since 2009 in Taiwan, there has also been a push for remote healthcare services, the transmission of EMR and medical images and value-added applications on healthcare databases. Taiwan’s Ministry of Health is also launching a plan to store healthcare data in a “healthcare cloud”, which would ease access to data.

These steps towards the digitization and standardization of datasets are key if the longer term goals of using big data analysis and AI are to be realized in Taiwan.

Not all technology requires the use of artificial intelligence, stated Zse-Hong Tsai, adding that, in many instances, companies need to look at the type of technological tools that they need according to the desired goal. Self-driving cars for example, require a quick local response, so AI might be more practical for this purpose, but other services might function just using big data and programming. He also stated that Taiwan’s place in this technology might be partnering with international companies on software coding and for localization of services. He pointed to vertical applications and services as an area that is still to be developed.

Although clean data is a big issue, increasing competition over AI talent is also a significant problem for companies that want to enter the AI field.

One of the major stumbling block for the AI Singapore Program is a lack of talent, according to its director of industry innovation, Laurence Liew. The venture is an attempt to facilitate more widespread adoption of AI+ technologies in the country. The talent shortage is particularly acute for small and medium-sized businesses and universities. As talent is so scarce, AI data scientists or data engineers find high paying jobs with big firms, and it’s hard to retain talent without significant reimbursement. Liew stated that even he was initially overly-optimistic about his ability to recruit AI talent, and had to reassess his approach when it came down to practicalities.

Currently his organization plans to recruit young talent for an AI Apprenticeship Program for fresh graduates who have graduated within three years and to train them on a full time basis and then provide them to companies

Taiwan has also started an AI talent cultivation project at the Academia Sinica, with a 200 member class, but you have to be a company employee and you have to pass certain tests, and this is a full time program for three months. So companies nominate an employee to take the course, normally from their IT departments. Chu expressed admiration for the Singaporean approach compared with Taiwan’s approach which entails company employees taking a substantial amount of time away from work for retraining.

In terms of the popularity of AI software in the APeJ, Google, Amazon, Microsoft and IBM have the largest share in the region, with Microsoft Azure Machine Learning being the most popular software in Taiwan, according to Chwee. Chwee added that as there is a shortage of Python programmers, and that there have been increasing attempts to create visual-based integrated development environments, to lower the bar for entry into the machine learning field.

- ‘Building a national electronic medical record exchange system - experiences in Taiwan’, Comput Methods Programs Biomed. 2015 Aug;121(1):14-20. doi: 10.1016/j.cmpb.2015.04.013. Epub 2015 May 5.

|

|

| Author: |

Conor Stuart |

| Current Post: |

Senior Editor, IP Observer |

| Education: |

MA Taiwanese Literature, National Taiwan University

BA Chinese and Spanish, Leeds University, UK |

| Experience: |

Translator/Editor, Want China Times

Editor, Erenlai Magazine |

|

|

|

| Facebook |

|

Follow the IP Observer on our FB Page |

|

|

|

|

|

|