|

Tsai Ing-wen at the 2017 Taiwan Business Alliance Conference in Taipei;

Source: Office of the President of the Republic of China

At the recent 2017 Taiwan Business Alliance Conference several international firms shared their experience of investing in Taiwan and the advantages of the Taiwanese market.

The forum opened with remarks from Taiwanese president Tsai Ing-wen, who referred to recently announced multi-billion dollar investments by Taiwan Semiconductor Manufacturing Co. and Winbond Electronics in Tainan and Kaohsiung. She also stated her government’s continuing commitment to industry reform and making Taiwan more “investment-friendly”. Specifically she referenced efforts to loosen regulations on raising capital, on company formation and registration and on the entry and stay of foreign talent and to tax reform efforts to make Taiwan “attractive to foreign talents”. She also mentioned the New Southbound Policy, an effort to diversify trade away from China by engaging with ASEAN member nations, countries in South Asia as well as Australia and New Zealand. The Executive Yuan’s Office of Trade Negotiations recently announced that the countries targeted under Taiwan’s New Southbound Policy had invested US$230 million in Taiwan from January to October, 2017. In total 2,719 foreign direct investment (FDI) projects worth a total of US$5,522,711,000 were approved from January to October 2017, according to Ministry of Economic Affairs figures. Taiwan ranked 15th in the Global Competitiveness Report of the World Economic Forum in 2017, fourth in Asia in the Ease of Doing Business Ranking 2016 by the World Bank, fourth in Asia in the International Property Rights Index 2016 and first in Asia in the Global Entrepreneurship Index 2016.

President of Applied Materials Taiwan, Erix Yu, suggested that Taiwan’s strength in science and maths was a very attractive factor for international firms looking to tap local talent. He stated that Taiwan has over 94,000 science and engineering graduates a year, 26,000 of which have a master’s or a Ph.D. The country is also ranked 3rd in eight-grade science and mathematics, he added.

The Ministry of Economic Affairs has posited Taiwan as an Asia-Pacific Logistics Hub, with an average flight time of 2.55 hours to major cities in Northeast and Southeast Asia, including Beijing, Seoul, Tokyo, Shanghai, Hong Kong, Singapore and Manila, and average shipping time of 56 hours from the Port of Kaohsiung to five major ports in the region, Manila, Singapore, Hong Kong, Shanghai and Tokyo.

Yu also praised Taiwan’s industrial clusters, comprising science parks and networks connecting businesses to suppliers and customers.

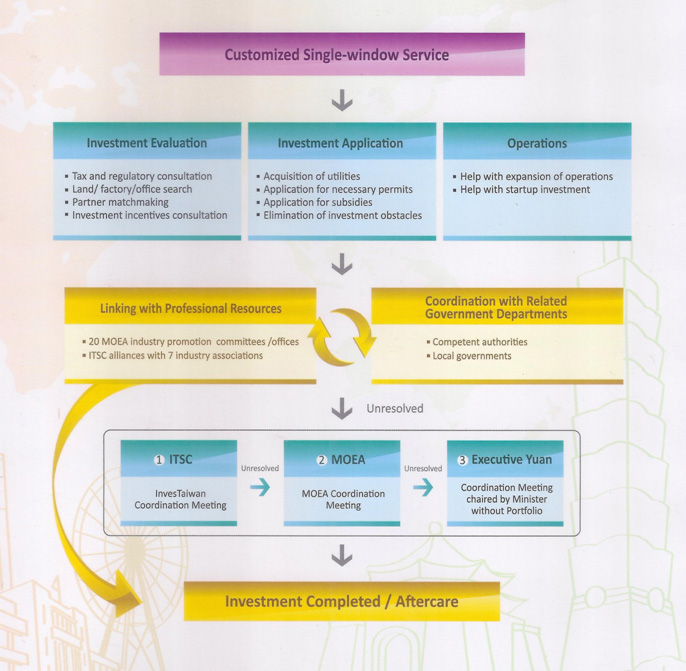

He stated that investors have the support of Taiwan’s government, that is strengthening IP protections and offers single-window services for companies interested in investing in Taiwan.

Figure 1: Single-Window Service; Source: InvesTaiwan Service Center

Incentive Measures:

- Tax incentives: business income tax has been cut to 17% and companies may offset up to 15% of their R&D expenditures against their business income tax due for the current year. Tax incentives are also available for companies in the biotechnology industry and there is a five-year tax holiday for private investment in major infrastructure projects.

- Special zone incentives: tariff free imports of machinery, equipment, raw materials, fuel and semi-finished products for companies operating in special zones including export processing zones, science parks, free trade zones and agricultural biotechnology parks. Exported products and services for these companies enjoy a zero tax rate.

- R&D Assistance and Subsidies: forward-looking R&D projects, integrated R&D projects and projects under the Program to Encourage Domestic Enterprises to Establish R&D Centers in Taiwan, the Global Innovation and R&D Partnership Plan, and the Small Business Innovation Research Program qualify for subsidies of 40% to 50% of the project’s total cost.

- Financing and Government Participation: The National Development Fund provides investment and provides low-interest financing for investment projects. The government has allocated NT$10 billion (US$330 million) respectively for investment in SMEs, cultural and creative industries, strategic services, and strategic manufacturing industries.

Taiwan has four industrial clusters, the northern area centered around electronic technology, the central area, focused on precision machinery, the southern area, focused on Petrochemical and heavy industry and the eastern area, focused on tourism. Deputy minister of economic affairs, Dr Ming-hsin Kung, expanded on the role of industrial clusters as follows:

Northern Taiwan:

- Nangang Software Park: ICT Design, digital content and biotechnology.

- Hsinchu Science Park, IC manufacturing, optoelectronics and biotechnology.

Central Taiwan:

- Changhua Coastal Park: metal products, metal coating, recycling, green energy and glass.

- Central Taiwan Science Park: semiconductors, optoelectronics, biotechnology and precision machinery.

Southern Taiwan:

- Southern Taiwan Science Park, Tainan, Liuying, Yongkang Technology Industrial Park: Optoelectronics, environmental protection technology, automotive parts and precision machinery

- Kaohsiung Linhai Industrial Park, Dafa Industrial Park, Software Park: petrochemicals, steel, yacht manufacturing, metal processing, precision machinery, IC, optoelectronics, communications and environmental protection technology.

Taiwan has 16 cutting-edge R&D institutes, including the Biotechnology Center, the Textile Research Institute, the Institute for Information Industry, the Metals Industries R&D Center, the Industrial Technology Research Institute, the Automotive Research & Testing Center, the Plastics Industry Development Center and the China Productivity Center.

Kung introduced the possible opportunities that will accompany Taiwan’s 5 + 2 Industrial Innovation Plan, comprising the development of an Asia Silicon Valley, Smart Machinery, Green Energy, Biomedical Industry, National Defense Industry, New Agriculture and the Circular Economy.

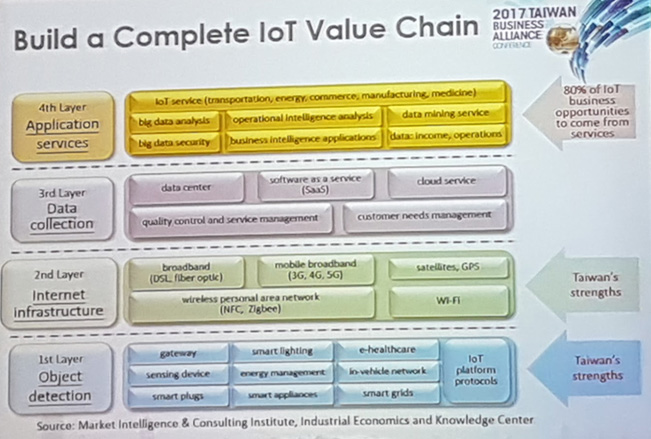

As part of the plan to develop an Asia Silicon Valley, he laid out Taiwan’s plans for a complete internet of things (IoT) value chain (See Figure 2).

Figure 2: Taiwan’s plan for building a complete IoT Value Chain;

Source: Market Intelligence & Consulting Institute, Industrial Economics and Knowledge Center

He stated that from 2013 to July of 2017, 196,946 new companies were founded in Taiwan, 10,994 of which are related to IoT services, and would likely prove as good partners for foreign-funded firms interested investing in Taiwan.

Kung stated that the business opportunities in the Asia Silicon Valley plan sector include the development of smart city applications and solutions, the provision of hardware, software, technology and other resources for the development of IoT applications and the provision of chips and equipment for AI, AR/VR and other key technologies.

Although Taiwan’s strengths lie in the first and second layer of the value chain, object detection and internet infrastructure respectively, he stated that 80% of business opportunities in the sector will come from the fourth layer, application services.

Kung also pointed to Taiwan’s strengths in the biomedical field, including its high quality health care system, its strict pharmaceutical standards, the high cost performance ratio of R&D and the robust ICT and manufacturing base.

Wang Chien-ping, head of the Department of Investment Services of the Ministry of Economic Affairs, took a different interpretation of the Asia Silicon Valley plan, stating that it should be read Asia - Silicon Valley, essentially connecting Taiwan to Silicon Valley in the US, as opposed to trying to replicate it in Taiwan, which he describes as one of the three “links” that Taiwan is trying to achieve: link with local resources, link to the future, and link with global markets.

Hajir Naghdy, head of Macquarie Capital, Asia and the Middle East was one of the representatives of foreign businesses asked to speak at the conference. Macquarie came to Taiwan in the early 2000s, initially developing a subscriber-based television company in Taiwan, they are now engaged in renewable energy projects, including the Formosa 1 Offshore Wind Farm.

Naghdy stated that Taiwan has had a consistent trend of economic growth for the last 20 years. He also praised the government’s proactive role in developing industries in Taiwan. He stated that the government was responsible for 44% of R&D spending in 1994, a move in which they facilitated the creation of the semiconductor industry in Taiwan, but that now government investment is a fraction of that, as foreign direct investment has taken up the slack. He pointed to Taiwan’s 70% market share in the semiconductor industry as proof of the ability of Taiwan’s government to follow through on its blueprints for industry transformation.

Naghdy expressed excitement at being involved in the green energy industry in Taiwan, given that the government has such a good track record on facilitating industrial development with smart policy and the sizeable investments in infrastructure. He pointed to the Forward-Looking Infrastructure Plan announced earlier in 2017, which mandated NT$880 billion (US$29.3 billion) of infrastructure spending, as one of the main drivers behind industrial transformation.

He used the example of the offshore wind farm, to suggest that these industries have knock-on effects on neighboring industries, and creates industries surrounding them, especially in a place like Taiwan which he says has an entrepreneurial spirit.

He also pointed to the possibilities in cost saving likely to result from IoT applications, giving the example of planes that fly through Asia vs those that fly in the US and Europe, stating that those in Asia had a completely different maintenance cycle from those in the US and Europe and IoT could play a role in tailoring maintenance schedules to different conditions in different locations. He stated that Taiwan offers unique opportunities, given its large market share of the global semiconductor industry when taken together with these ambitious new industrial sectors that are being developed.

|

|

| Author: |

Conor Stuart |

| Current Post: |

Senior Editor, IP Observer |

| Education: |

MA Taiwanese Literature, National Taiwan University

BA Chinese and Spanish, Leeds University, UK |

| Experience: |

Translator/Editor, Want China Times

Editor, Erenlai Magazine |

|

|

|

| Facebook |

|

Follow the IP Observer on our FB Page |

|

|

|

|

|

|