|

Yu-ting Kuo, chairman of the Canxin Group

For many observers Taiwan’s New Southbound Policy may sound good, but there are lingering doubts about the feasibility of competing with neighboring powers, such as China, South Korea and Japan, which have all been zeroing in on the member nations of the Association of South East Asian Nations (ASEAN) in recent years, and some of which have already long laid the groundwork to push forward cooperation.

At a recent conference in Taipei a Taiwanese businessman who started a company in Vietnam gave insight into the challenges that lie ahead if Taiwan is to make inroads in the region.

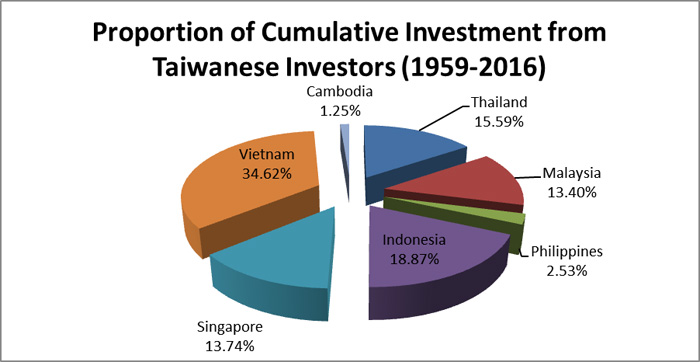

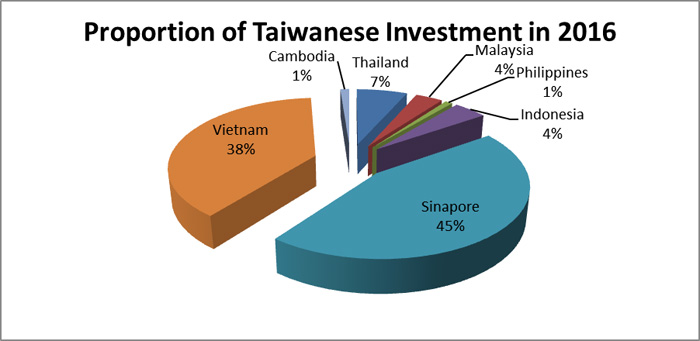

Vietnam was the second largest investment target in ASEAN in 2016 in terms of Taiwanese overseas investments, with 216 investments, making up a total of US$1.3 billion in investment (See Figure 2), according to figures collated by Taiwan’s Ministry of Economic Affairs. Vietnam has seen the largest cumulative investment total, from 1959 to 2016 of all ASEAN countries, as shown in Figure 1.

Figure 1: Proportion of Cumulative Investment from Taiwanese Investors (1959-2016);

Source: Ministry of Economic Affairs, collated by Conor Stuart

Figure 2: Proportion of Investment from Taiwanese Investors 2016;

Source: Ministry of Economic Affairs, collated by Conor Stuart

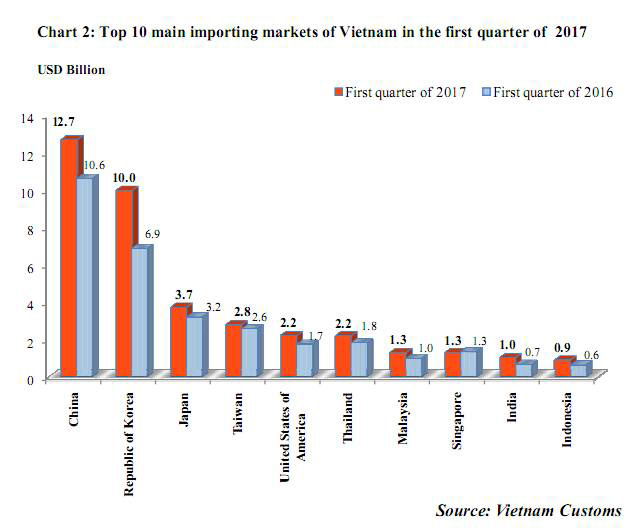

Taiwan ranked as the third largest import market for Vietnam, following China, the Republic of Korea and Japan. Imports from Taiwan were up US$200 million on last year, whereas Japan, South Korea and China all saw more dramatic rises in imports, with US$500 million, US$3.1 billion and US$2.1 billion respectively (See Figure 3)」

Figure 3: Top 10 import markets of Vietnam in the first quarter of 2017;

Source: Vietnam Customs

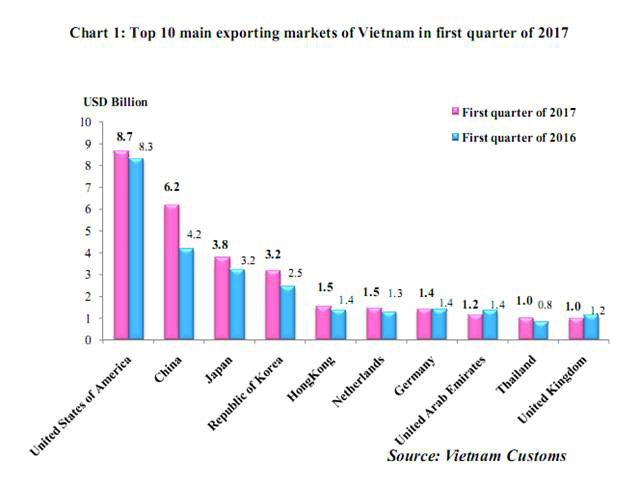

The United States was the top export market for Vietnam in the first quarter of 2017, with exports valued at US$8.7 billion, followed by China, with exports valued at US$6.2 billion, representing dramatic year-on-year growth of US$2 billion, Japan, with exports valued at US$3.8 billion and South Korea, with exports valued at US$3.2 billion (See Figure 4). Taiwan did not feature in the top 10 markets.

Figure 4: Top 10 export markets of Vietnam in the first quarter of 2017;

Source: Vietnam Customs

In terms of average imports from 2011 to 2015, Taiwan has also ranked fourth in terms of import markets, behind China, South Korea and Japan (See Table 1).

Rank |

Country |

Imports (US$m) |

Proportion |

1 |

China |

36,786.46 |

27.6% |

2 |

Republic of Korea |

19,749.76 |

14.8% |

3 |

Japan |

12,155.70 |

9.1% |

4 |

Taiwan |

9,709.62 |

7.3% |

|

Total |

133,196.46 |

100% |

Table 1: Vietnam import rankings on average from 2011-2015; Source: Vietnam Customs

In terms of exports in the same period however, Taiwan ranked 19th, while the United States, China, Japan and South Korea were all featured in the top four (See Table 2).

Rank |

Country |

Exports (US$m) |

Proportion |

1 |

United States |

24,514.58 |

18.7% |

2 |

China |

13,932.92 |

10.6% |

3 |

Japan |

13,301.46 |

10.1% |

4 |

Republic of Korea |

6,643.82 |

5.1% |

19 |

Taiwan |

2,107.64 |

1.6% |

|

Total |

131,140.32 |

100% |

Table 2: Vietnam import rankings on average from 2011-2015; Source: Vietnam Customs

Kuo suggested that the Taiwanese government encourage tariff reductions or exemptions for Taiwanese businesses in terms of policy roll-out to improve Taiwan’s competitiveness.

From 1993-2012, US$80 billion was committed to Vietnam in official development assistance (ODA) funds, and Japan and South Korea were among the top three sources of these funds (See Table 3). Kuo stated that comparing the table below to Vietnam’s import ranking (See table #), suggests that ODA has a clear benefit to Japanese and South Korean businesses.

Entity Type |

Rank |

County/Organization |

ODA Amount |

Country |

1 |

Japan |

US$19.8 billion |

Country |

2 |

France |

US$3.9 billion |

Country |

3 |

South Korea |

US$23.3 billion |

International Development Bank |

1 |

World Bank |

US$20.1 billion |

International Development Bank |

2 |

Asian Development Bank |

US$14.2 billion |

Total promised aid 1993-2012 |

US$80 billion |

Table 3: Overseas Development Assistance promised to Vietnam 1993-2012; Source: Kuo Yu-ting’s presentation.

On this basis, he suggested that the Taiwanese government should provide Vietnam with ODA funds on a similar scale to Japan and South Korea, and have Taiwanese companies bid for ODA contracts. This would not only increase Taiwan’s influence, but also strengthen the competitiveness of Taiwanese businesses in the country.

Talent Cultivation

Top ten countries of origin for foreign nationals at Taiwanese institutes of higher learning in 2016 |

China |

41,981 |

Malaysia |

16,051 |

Hong Kong |

8,662 |

Japan |

7,548 |

Macau |

5,295 |

Indonesia |

5,074 |

Vietnam |

4,774 |

South Korea |

4,624 |

United States of America |

4,002 |

Thailand |

1,179 |

Table 4: Top ten countries of origin for foreign nationals at Taiwanese institutes of higher learning in 2016; Source: Statistics Office of the Ministry of Education

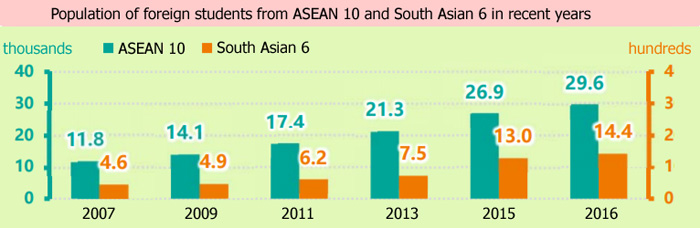

The numbers of students from ASEAN member nation countries has risen over recent years (See Table 4), which suggests a source of human capital that can meet the demand for Vietnamese staff members in Taiwanese companies. Vietnamese students in Taiwan were the sixth most populous group of foreign students, numbering 4,774. They were the third most populous group from ASEAN countries, following those from Malaysia and those from Indonesia. ASEAN student numbers have been trending upward over recent years growing from 11,800 in 2007 to 29,600 in 2016 (See Figure 5). Students from the South Asian 6 (India, Sri Lanka, Bangladesh, Nepal, Bhutan and Pakistan) have come in fewer numbers, however.

Source: Statistics Office, Ministry of Education

Of the Vietnamese students studying here in 2015, the two most popular fields of study were “social sciences, business and law”, accounting for 49.4% of students and “engineering, manufacturing and construction”, accounting for 19.5% of students (See Table 5).

Top 9 Fields |

Total |

Malaysia |

Vietnam |

Indonesia |

India |

Japan |

Asian Countries |

Non-Asian Countries |

Total Students |

15,792 |

4,465 |

2,586 |

1,623 |

803 |

791 |

12,668 |

3,124 |

Education |

3.5% |

2.3% |

3.6% |

4.4% |

0.2% |

10.2% |

3.7% |

2.8% |

Humanities and Arts |

16.5% |

24.4% |

15.9% |

8.3% |

1.0% |

33.0% |

18.2% |

10.0% |

Social Sciences, Business and Law |

35.2% |

27.1% |

49.4% |

32.0% |

7.8% |

29.5% |

34.0% |

40.1% |

Sciences |

7.2% |

4.9% |

5.1% |

10.8% |

32.5% |

2.1% |

7.4% |

6.4% |

Engineering, Manufacturing and Construction |

19.5% |

12.0% |

19.5% |

31.5% |

52.2% |

4.4% |

18.4% |

23.9% |

Agriculture |

2.9% |

2.7% |

1.7% |

3.8% |

0.2% |

1.6% |

2.6% |

4.2% |

Medicine, Health and Public Welfare |

5.5% |

5.6% |

1.4% |

4.5% |

5.6% |

4.7% |

4.4% |

10.1% |

Services |

9.5% |

21.1% |

3.4% |

4.6% |

0.1% |

14.4% |

11.3% |

2.5% |

Other |

0.0% |

0.0% |

0.0% |

0.0% |

0.2% |

0.0% |

0.0% |

0.0% |

Table 5: Top Nine Fields of Study for Foreign Students in Taipei; Source: Office of Statistics, Ministry of Education

Kuo stated that one of the most important aspects of investing in a factory in Vietnam is human resources, and that although Vietnam has a literacy rate of 92%, only 7.3% of the population have graduated from university. So these students studying in Taiwan could help make up the skill shortage.

He also suggested that if the tax burden on Taiwanese businesses in Vietnam could be reduced if they send their Vietnamese workers to Taiwan to study, to improve their skills, this would enable them to better retain talent and could also aid Taiwanese universities, which are suffering the impact of dropping birth rates.

Kuo stated that 70% of Taiwanese enterprises have overseas business units (OBUs) to facilitate overseas investments, for certain financial operations (investments, sales, privacy, flexibility) as well as to reduce tax burdens and to avoid liability.

The government has also been trying to resolve industrial land shortages for businesses in Taiwan, to encourage companies to move their businesses back to Taiwan and expand existing businesses. Although supply of industrial land surpasses demand, with 700 hectares of land lying idle, industry reports a need for 580 hectares. Much of this has to do with the cluster effect of how industries generally organize themselves in Taiwan, with certain regions being home to certain industries.

Kuo suggests that the answer to this problem could be for the government to incorporate tax incentives or exemptions for businesses to increase take up of unused industrial land that would render the OBUs unnecessary. He says this would also result in more funds flowing back into Taiwan, in concert with incentives for the use of green energy and for the “circular economy” initiative.

In terms of investment targets within Vietnam, Kao suggested the Binh Duong Province that lies 25km north of Ho Chi Minh, which is set to become the direct-controlled municipality of Binh Duong in 2020, as having a promising future. The province comprises 2,694.43 km², with one provincial city, Thu Dau Mot, four district-level towns, Thuan An, Di An, Ben Cat and Tan Uyen and four counties, Dau Tieng, Bac Tan Uyen, Phu Giao and Bau Bang. It is well connected in terms of highway links and has a population of roughly 2.5 million, roughly 60% of whom are under 35.

Kuo stated that 80% of Taiwanese businesses in Vietnam are concentrated in Ho Chi Minh and the surrounding provinces, such as Dong Nai, Binh Duong and Ba Ria-Vung Tau, a region which contributes to over 40% of the national GDP.

Foreign businesses in Vietnam are engaged in labor intensive industries, including shoe manufacturing, textiles, bicycle manufacturing, scooter manufacturing and wooden furniture manufacturing.

Binh Duong ranked third in terms of foreign direct investment in the first half of 2016, accounting for 12.07% of the total FDI (See Table 6).

Region |

Total FDI |

Proportion of total FDI |

Haiphong City |

US$1.7 billion |

15.4% |

Hanoi City |

US$1.6 billion |

14.45% |

Binh Duong Province |

US$1.1 billion |

12.07% |

Dong Nai Province |

US$928 million |

10.47% |

Table 6: Top four ranking of administrative divisions in terms of FDI in the first half of 2016;

Source: Kuo Yu-ting’s presentation

In terms of foreign direct investments projects licensed in 2016, Binh Duong saw investment of US$2.6 billion, divided over 260 cases, giving it an average investment per case of US$10 million.

Cities, provinces |

Number of projects |

Total registered capital (Mill. USD)(*) |

Average Capital per project (Mill. USD) |

Ho Chi Minh City |

853 |

3896.9 |

4.6 |

Ha Noi |

462 |

3390.0 |

7.3 |

Hai Phong |

54 |

3043.2 |

56.4 |

Dong Nai |

95 |

2562.3 |

27.0 |

Binh Duong |

260 |

2550.4 |

10.0 |

Bac Giang |

54 |

1028.5 |

19.0 |

Long An |

125 |

934.6 |

7.5 |

Bac Ninh |

188 |

924.9 |

4.9 |

Ha Nam |

32 |

727.2 |

22.7 |

Ba Ria - Vung Tau |

18 |

724.7 |

40.3 |

Table 7: Source: Foreign direct investment projects licensed in 2016 top administrative divisions (provinces and cities); Source: Vietnam General Statistics Office

Kuo also pointed out some other advantages that Taiwan has in relation to Vietnam. As of the end of September in 2016, Vietnamese foreign spouses in Taiwan accounted for 56.4% of all foreign spouses, numbering 95,500, which suggests the number of people with blood ties to Vietnam likely number above 208,000 across Taiwan, projecting from the approximate birth rate of 1.175 children per woman in Taiwan. He also pointed out that Taiwan’s median age is around 10 years older than Vietnam’s. He suggests that increased interaction between the countries could be a win-win, in that Taiwan can benefit from a boost to its population and Vietnam can receive more investment.

He also pointed to the shared influences of Chinese cultural traditions in Taiwan and Vietnam.

The Canxin Group was originally an property development company, but later evolved into a company facilitating the entrance of foreign companies into the Vietnamese market.

|

|

| Author: |

Conor Stuart |

| Current Post: |

Senior Editor, IP Observer |

| Education: |

MA Taiwanese Literature, National Taiwan University

BA Chinese and Spanish, Leeds University, UK |

| Experience: |

Translator/Editor, Want China Times

Editor, Erenlai Magazine |

|

|

|

| Facebook |

|

Follow the IP Observer on our FB Page |

|

|

|

|

|

|