|

Photo 1: National Singapore University Professor Jin-chuan Duan; Photo by Clarence Chiang

Reading the mission statement of any FinTech startup these days, you'll almost certainly see the word "platform" used, however, as platform-style business models offer increasingly similar services profitability sinks, and many players end up getting forced out of the market. This makes a proper understanding of business analytics essential.

FinTech has always existed, according to National University of Singapore professor Dr Jin-chuan Duan, "Technology is a relative concept. In the 1960s, when ATMs had just started to appear, the public didn't need to go to a bank to take money out of their accounts, that was an advanced technology at the time." Digital stock trading, credit cards, internet banks and even more recently, e-payments, P2P lending and Bitcoin, are all just products of the evolution of financial technology.

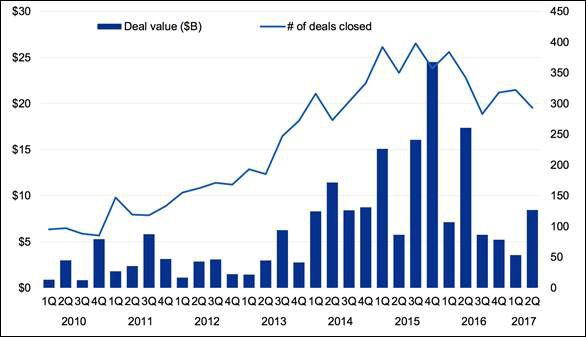

If one focuses on the 10 years of the FinTech trend with the rise of the internet and e-commerce, the biggest difference with the past is that many non-traditional financial and technology businesses have been involved, at the same time it's also changed the long-held ecosystem of the financial industry. For example, the total value of mergers, acquisitions and investment in the FinTech sector was US$9 billion in 2010, but by 2016 this increased to US$25 billion. Duan suggested that this is because FinTech can create differentiated products across different fields, but of course it also poses a challenge to regulatory systems.

However, this tide of funding for the FinTech industry has undergone a change in the last year. FinTech has absorbed a large amount of venture capital funding since 2010, especially in 2015, which saw a total of US$60 billion, but there was a sharp decline in 2016, with only Q2 breaking the US$1.5 billion mark. Although the second quarter of this year saw a rebound, it's still a decline on the second quarter of 2016, with funding reduced by almost 50% (See Figure 1).

Figure 1: FinTech venture capital funding in each quarter from 2010 until the present

Source: Pulse of Fintech Q2 2017, KPMG

FinTech Funding Falls Fast in 2016

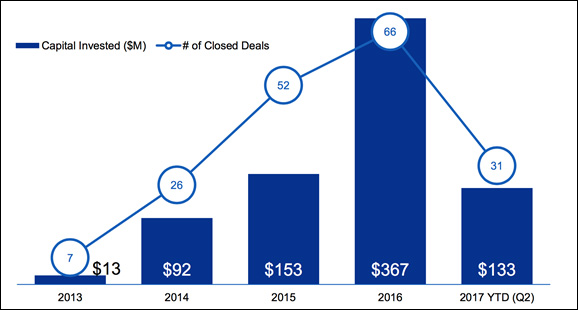

The figures around global venture capital investments in blockchain firms paint a more interesting picture still. In the past six months, bitcoin and ether (the Ethereum blockchain currency) have hit several new highs, and have been followed closely by investors around the world. However, in the same period, venture capital funding investments in blockchain firms have not seen any increase, with only US$133 million invested, not even half of the amount in 2016. In other words, this widely anticipated technology's ability to attract funds is quietly declining (See Figure 2).

Figure 2: Venture capital funding of blockchain from 2013 to present

Source: Pulse of Fintech Q2 2017, KPMG

Why has FinTech lost its lustre? Duan stated that FinTech focused on transactional technology is very easy to standardize, which also brings down profit, so those industry players that are unable to secure a significant enough market scale will find themselves forced out of the market. "As the barrier to entry is low, it leads to low profits for enterprises," he said. Taking P2P lending platforms in China as an example, he stated that in 2015, there were over 5000 lending platforms, but the rate of profits from 2014-2016 fell from 19.75% to 9.76%, because of too many new entrants, and later Chinese policymakers cracked down on internet-based lending platforms introducing more regulation. As of May of 2017, there were only around 2000 internet lending platforms still operating.

In other words, if these transactional technology-based FinTech businesses aren't able to differentiate themselves, sooner or later they'll face a risk of losing out to the competition. How can you differentiate your company in a highly standardized and ever-changing battlefield? Duan stated if one's goal is advanced and sustainable technological know-how, one must cultivate business analytics know-how, that is to say to use data to find and keep customers, and raise profits.

Deep Analytics Know-How Can Make for Sustainable Competition

This form of analytics, commonly known as big data analytics, won't be unfamiliar to the business world, but Duan, who is an economist by training, stated that what business analytics does, is far from just a superficial analysis of data. "For example, from data analytics we might find that A is has better credit than B, so you would be better to do business with A; but leaving it here is not enough, we should continue to ask, to what extent is A's credit better than B? And is it possible that in the future B will have better credit than A? And what factors are behind all this?"

Duan stated that big data must evolve into smart data for there to be any meaningful analysis. From 2009 onwards, he's developed the Credit Research Initiative (CRI) at the Risk Management Graduate Institute of the National University of Singapore, which suggests deep analytics of the relationality between probability of default, term structure, and defaults as an alternative credit rating system. One of its most striking features is that it's able to predict changes in credit risks for a company in the next five years. "A company's level of credit does not remain fixed, good and bad periods can be transitory, and it is only with the idea of term structures that we can become aware of when and under what conditions to interact with them."

From CRI's establishment, Bloomberg, Thomson Reuters and the International Monetary Fund have all worked with Duan, and CRI already covers 65,000 listed companies in 121 countries, but Duan is still not satisfied. "This system should be able to react by adjusting the weighting or adding variables more quickly, but this task relies on human intervention."

Therefore, using artificial intelligence technology, to lower human interference to the lowest possible level is his next objective. "FinTech doesn't have to be big, but it has to be deep. It's only when one is unique that one doesn't have to worry about getting eliminated from the market," said Duan.

|

|

| Author: |

Clarence Chiang |

| Current Post: |

Senior Editor, NAIP Newsletter |

| Education: |

Business Administration, National Chengchi University, Taiwan |

| Experience: |

Reporter, CommonWealth Magazine

Reporter, Business Today Magazine |

|

|

|

| Facebook |

|

Follow the IP Observer on our FB Page |

|

|

|

|

|

|