Figure 1: Co-founder of Ethereum Vitalik Buterin gives a talk to the Taipei Ethereum Meetup earlier this year;

Source: Taipei Ethereum Meetup Youtube channel screenshot

On July 18 the chair of Fubon Financial Holdings announced that Taiwan’s Financial Supervisory Commission has loosened regulations to allow using robots in the financial services industry. The FSC has also already given permission for account transfers using blockchain technology, but the proposal has still to be approved by Taiwan’s Central Bank.

Chair of Fubon Financial Holdings, Tsai Ming-hsing, was cited by NDTV recently as stating, “Of course everyone wants to push the regulatory sandbox and I think that the regulations should be loosened as much as possible. As this is a new experiment, we’re trying something new.”

Former member of the Financial Supervisory Commission, Wang Li-ling, who now serves as the director of National Chengchi University’s FinTech Research Center, was also cited by the media outlet as stating, “The problem is that we don’t have any clear limits set in terms of regulation.”

Much has been made of Bitcoin and blockchain technology and how it will impact industry. Bitcoin has been popularized to the extent that members of the public in Taiwan can now buy Bitcoin at their local convenience store branches, for example. Another blockchain platform called Ethereum, has also been rolled out since July 2015, with many early investors seeing the currency soar. The Ethereum platform’s currency ether was recently listed on one of China’s main virtual currency trading platforms, Huobi. Co-founder of Vitalik Buterin recently visited Taipei and gave a talk at a blockchain technology workshop at NCCU, hosted by the Taipei Ethereum Meetup group.

Despite a lot of activity around blockchain technologies, including industry-academia alliances based in universities, regulatory changes have been slow in Taiwan, limiting the speed at which the new technology can be adopted.

Is the Ethereum Platform just a rip-off of Bitcoin’s Value Storage Model?

Ether is not just a decentralized currency, however, as in the initial period since its launch it has been the subject of speculation, much like Bitcoin. Distinct from Bitcoin, however, the Ethereum platform has begun to change the way companies fundraise and may impact the way we use applications in the future.

The main differences between the Bitcoin platform and the Ethereum platform is the use of a Turing-complete programming language, that enables it to serve as a coding platform on which applications can be built, whereas Bitcoin is solely used for storing value. Using the same platform companies can then fundraise for their applications built on the Ethereum platform with initial coin offerings (ICO), a way of raising funds comparable to an initial public offering, under which in-app tokens or coins are given to investors in exchange for investment, which they can redeem for app use or exchange in the event the app is a success and the coins grow in value. How these coins would then be used in app for certain functions depends on how the app is designed. Gnosis, a market prediction app, built on the Ethereum platform, for example, raised US$12.5 million in just 12 minutes in its initial coin offering on April 24, 2017, in which it sold 500,000 of its 10 million coins or tokens. This followed other successful ICOs from Ethereum-based e-sports platform FirstBlood, Ethereum-based entertainment platform SingularDTV, and Ethereum-based market for renting out idle computing power Golem. Upcoming and ongoing ICOs are listed on platforms such as the Smith + Crown.

These apps themselves require a certain amount of computing power, or “gas” to function, the price of which is set using the Ethereum currency, ether. Although the Ethereum platform is currently proof-of-work based, like Bitcoin, whereby coins are awarded to miners who solve cryptographic puzzles first, the system will undergo a big shift with the introduction of the Metropolis update, likely at the end of this summer, to a proof-of-stake model using the Casper algorithm, whereby the validator of next block is chosen with an pseudo-random algorithm, based on the account wealth. This shift is partially due to the heavy electricity use needed for mining, and validators will instead have to lock in a stake to guarantee their good behavior in validating blocks, rather than mining, to earn ether. This should also increase the throughput of the Ethereum blockchain and make it more scalable.

An enterprise version of the platform, called Quorum, has already been released, driven by a coalition of businesses called the Ethereum Enterprise Alliance, with 150 members ranging from banking groups, like JP Morgan, BBVA, and Santander ING, to consulting firms, such as Deloitte, Accenture, technology and software giants such as Intel and Microsoft, as well as range of blockchain and IT companies, including Taiwan’s AMIS and Shanghai-based ANDUI. More recent additions include Mastercard and Cisco Systems. Taiwanese banks, including Fubon Financial Holdings and Taishin Holdings are also members of the alliance. The enterprise version of the platform still functions as part of the Ethereum blockchain, but just introduces security gateways similar in concept to the SSL certificate in the use of the HTTPS protocol vs HTTP.

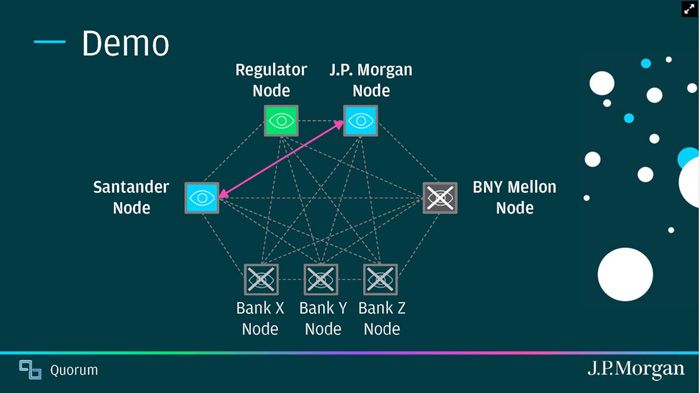

At the launch of the Ethereum Enterprise Alliance in March, the participants ran through a demo of how the Quorum platform would work (see Figure 1):

Figure 1: Quorum Demo; Source: Ethereum Alliance Launch Webcast Presentation

This demo shows how transactions can occur between two parties and how these transactions appear to those party to the transaction, to regulators and to third parties on the Quorum platform. This allows regulators to monitor transactions, while hiding the amount of the transaction from other parties, who could otherwise gain a competitive advantage from the information.

The Ethereum Foundation, the body behind the inception of the Ethereum blockchain, is also working with another blockchain technology z-cash to incorporate zero-knowledge succinct non-interactive arguments of knowledge (zk-SNARKS) into the Ethereum platform, cryptography which is able to hide information on senders, receivers and amounts in a way that the pseudonymous open-ledger Bitcoin cannot.

Taiwanese banks have been encouraged by the government to embrace FinTech, as we have previously reported, but many banks have struggled to innovate, often outsourcing this to other companies. Taiwan has also lagged behind its neighbor China and the rest of the world in the loosening of regulation around FinTech and even third-party transactions.

Ethereum is set to change more than just the banking sector, as can be seen by the wide variety of industries from which the membership of the Ethereum Enterprise Alliance is drawn, including pharmaceutical companies, energy companies, as well as local governments. The Alliance recently announced that it has set up a Technical Steering Committee, incorporating seven workgroups aimed at building up Ethereum architecture in different industries, including banking, healthcare, insurance, advertising, the legal services industry and supply chains.

|

|

| Author: |

Conor Stuart |

| Current Post: |

Senior Editor, IP Observer |

| Education: |

MA Taiwanese Literature, National Taiwan University

BA Chinese and Spanish, Leeds University, UK |

| Experience: |

Translator/Editor, Want China Times

Editor, Erenlai Magazine |

|

|

|

| Facebook |

|

Follow the IP Observer on our FB Page |

|

|

|

|

|

|