Although 2016 has not been a disaster for the patent sector in Taiwan, it’s been a year with a lot of changes. At the end of last year, a new president of the Taiwan Patent Attorneys Association, Justin K.S. Wu, was appointed, bringing new energy to the association; Then in July, Wang Mei-hua, who had served for 17 years as the head of the Taiwan Intellectual Property Office, was promoted to vice minister of economic affairs. She was replaced by her deputy, Sherry Hong, who formally took office in August.

As well as these personnel shuffles, 2016 was a year that saw the rise of new technology and industry transformation, which had an effect on patent applications. There was clear growth in the number of patent applications in the FinTech and green tech sectors, due in part to industry demand and in part to government promotion. However, facilitating innovation and raising awareness about IP protections remain a big challenge for the intellectual property office.

The number of patent applications in Taiwan has continued to fall over recent years, even though there has been a slight rise of late, largely attributable to design and utility model patents. This offers a stark contrast with China, where the patent application rate has continued to climb at a fast pace. There were 1,010, 406 patent applications made in China in 2015, according to World Intellectual Property Office figures, more than the numbers in the US (526,296) and Japan (454,285) combined. Given the dual threads of competition and cooperation that tie Taiwan and China, what role should the intellectual property office play?

The Cross-strait Patent Forum, held in the second half of each year, is also a time for reflection on the year. The IP Observer took this opportunity to interview the newly appointed TIPO director general Sherry Hong, not only to invite her to reflect on her achievements in the short time she’s been in office, but also to discuss the future policy of the intellectual property office and the responsive measures she intends to take in terms of cross-strait competition and cooperation.

Hong graduated from the law department of National Chung Hsing University, going on to undertake her master degree from the Franklin Pierce Center for Intellectual Property at the New Hampshire School of Law. She has worked at the Taiwan Intellectual Property Office since it took its modern form under the Ministry of Economic Affairs in 1999, serving as the head of the trademark division, as secretary general and as deputy director general.

IP Observer: The 9th Cross-strait Patent Forum of 2016 has already come to a close, do you have any hopes for cross-strait cooperation in the area of intellectual property rights? Given the speed of development in the patent sector over recent years, is there anything that Taiwan should learn from China in this respect? And in what areas does Taiwan have an advantage?

Sherry Hong: China first began to implement its intellectual property strategy back in 2008, incorporating it into each of its five-year-plans in order to accelerate the development of IP in tech and industry. They are encouraging industry professionals to be cognizant of the importance of patent strategy when moving into the international market, and providing inventive measures to maintain the growth in quantity of patent applications. Lots of new forms of service have arisen, like, for example, patent valuation, financing, and transaction platforms, to aid industry in heightening the economic value of patents, which has driven China to become one of the most important IP markets in the world.

We need to consider the niche areas for Taiwanese businesses. When planning out their business strategies, many business leaders take cross-strait relations as a base for regional plans, in the hope that they can get patent protection on both sides of the Taiwan Strait. Although Taiwan's market is smaller in scale, the R&D investments from business leaders and the results of this R&D have continued to accumulate. Lots of valuable patents for industry have been the result of innovation by small and medium-sized businesses (SMEs) or individuals. In terms of what intellectual property services Taiwan can offer, they may be niche, but Taiwan is capable highly professional in terms of service.

With China’s rapid development, it has become one of the most important markets in the world. I think that our office has to assist patent applicants on both sides of the strait by ensuring cooperation in patent applications across the strait, to offer protection for the results of industry R&D and to promote the development of industry.

To speak more broadly of the level of exchange across the strait in the intellectual property sector, China's patent strategy has clear objectives: to establish systems which enable applications by industry, patent financing, the valuation of patented technology and patent transaction platforms, these are things that we should learn from China. Taiwan's advantage lies in the innovative and spirited way that its SMEs adapt to economic and technological developments; however, Taiwan comes up short when it comes to intellectual property strategy, access to finance and the international market, which is something that the government needs to take an active role in addressing.

From 2010, China and Taiwan began to recognize priority applications from either side of the Taiwan Strait (China only recognizes priority applications from local Taiwanese applicants), which served as a massive milestone. Subsequently we also arranged exchange initiatives between patent examiners across the strait, and the advantages these kinds of cooperative schemes have brought to applicants from both sides of the strait are clear to see. The cross-strait forum serves as an opportunity for exchange and we hope that cooperation between the two intellectual property offices on either side of the strait, such as the talks concerning a priority document exchange (PDX) agreement and a patent prosecution highway (PPH), will continue to move forward.

IP Observer: How do you interpret the continuous downward trend in Taiwanese invention patent applications?

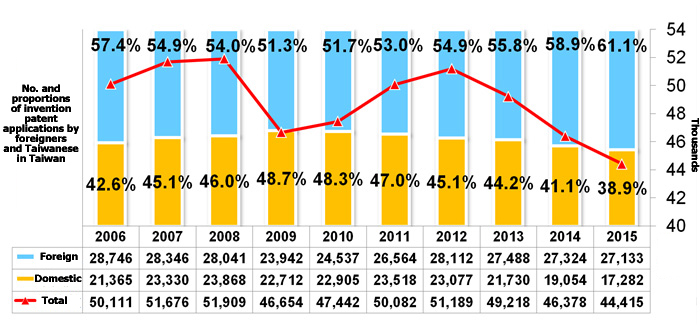

Hong: Over the last three years (2013-2015) Taiwanese invention patent applications have fallen 9.75%. Among them the number of applications from foreign applicants has remained steady, with the drop mainly owing to a reduction in applications from local applicants (See Figure 1). What's worth noting is that filings from foreign applicants for the first half of 2016 (with 13,175 applications) are up slightly from the first half of 2015 (with 13,085 applications), year-on-year growth of 0.69%.

Over the last three years this office has gradually come to understand the reasons behind the decline in Taiwan's application numbers among industry, academia and research institutes. The major reasons can be classified as follows:

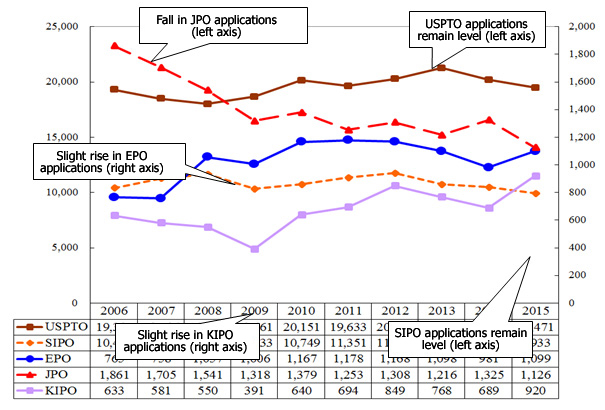

- Adjustment in patent target markets: Businesses are competing in the US and Chinese markets, and given that they have limited resources, they've always prioritized the US and Chinese markets, and this has led to a decrease in domestic applications. Analyzing the number of applications by Taiwanese applicants to the five biggest intellectual property offices, those in the US, China, Europe, Japan and South Korea, one can see that Taiwanese applications to the USPTO and China's State Intellectual Property Office (SIPO) have remained level, while invention patent applications to the Japan Patent Office (JPO) have fallen. In Europe and South Korea, however, there have been slight rises in Taiwanese invention patent applications. This shows that Taiwanese applicants are continuing to invest in patents in the two biggest markets, the US and China (see Figure 2).

- A shift from quantity to quality: Some applicants who originally had quite a high volume of applications (such as Hon Hai Precision Instruments, aka Foxconn) have adjusted their patent strategy, shifting away from their previous model of succeeding through quantity, to prioritizing quality, which has contributed to the relatively steep drop in the number of applications.

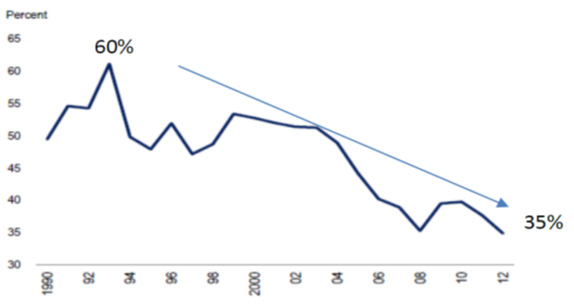

- Reduction in funds for patent applications due to the under-performance of the global economy, especially for Taiwan which counts China (including Hong Kong) among its major export markets (making up roughly 40%). As China has fostered its own supply chains and brands, replacing imports, Chinese imports of components have gone from constituting 60% of Taiwanese exports in 1990 at the peak, to just 35% in 2012 (see Figure 3). Cross-strait industry ties have gone from vertical division of labor to horizontal competition, with an ever increasing threat to Taiwanese exports. This has reduced profit for Taiwanese manufacturers, and limited their ability to reinvest in R&D and patent applications.

- Changes to patent application incentive measures: Our understanding is that when academic research institutions are evaluating whether or not to apply for a patent, they do so on the basis of whether or not they will be able to license the technology for use (technology transfer). They also require the developer or professor in question to put up a certain proportion of the application fees, which has led to a reduction in willingness to apply for patents. Some inventions relate to core technology, so there is a certain period of delay until the ideal time to commercialize it. If patent applications are not timely, this leads to inventions going without the patent protections they need.

- Earnings from patents not in line with expectations: academic research institutes and private companies have applied for a large quantity of patents in the past, so they're under a heavy burden of renewal fees. In addition to this, these expenses are not being covered by income from patent licensing or assignment. This limits the amount of funds they have to apply for new patents and reduces their willingness to apply.

- Patent holders have quite a low success rate in infringement cases at the Taiwan Patent Court. Even if they do win, compensation rates are low, which give patent holders little advantage. This has also decreased the appeal of applying for a Taiwanese patent.

- One factor for the rather large fall in invention patent applications by local applicants in Taiwan is the effect of the larger economic climate, including our poor economic performance and the relocation of factories and R&D units overseas. Another factor is the result of a change in patent strategy and in target markets. Although Taiwan's patent application rate has fallen, it does not follow that Taiwan's ability to innovate has also dried up. With a low level of innovation it is easy to design around granted patents and it often proves difficult to derive any real advantage from asserting one's patent rights in infringement litigation, or even to scare off competitors from continuing to infringe. As one is unable to make use of the value or the function of the patented technology, the benefit to industry cannot be maximized by making the technology public, and so people are often unwilling to apply for patents, preferring trade secret protections. Essentially, a fall in applications does not mean that there is innovation happening.

- Currently Taiwan is very strong in its R&D and innovation capability. The government has long been promoting cooperation between academia and industry in R&D, as well as continuing to invest in R&D itself and to promote R&D schemes, including the major and minor industry-academia alliances, subsidizing research institutes in forming technology germination centers and so on. However, for industry, academia and research institutes, the question remains as to whether or not applying for patents can meet their expectations in terms of the return on investment, giving them more funds to apply for more patents. As well as government incentive measures, the level of importance with which academic and research institutions look on patent protection is also key. If we look at National Tsing Hua University as an example, the school earned NT$114.4 million (US$3.6 million) from technology transfers in 2015, of which revenue from patent licensing constituted 61%. After deducting outgoings, they went on to put 35% of this revenue towards patent application funding for the following year, creating a virtuous cycle. This is a very successful case and it is necessary that we actively work towards spreading this success to other academic and research institutes, to help industry-academia cooperative ventures monetize patents and to allow current patents to remain in effect, as well as not negatively affecting people’s willingness to apply for patents.

Figure 1: Number and proportions of invention patent applications by foreign and Taiwanese applicants from 2006-2015;

Source: TIPO annual report

Figure 2: Invention (utility) applications filed by Taiwanese applicants to the five largest patent offices from 2006-2015; Source: Annual reports of USPTO, SIPO, EPO, JPO and KIPO

Figure 3: Chinese component imports expressed as a percentage of Chinese exports;

Source: Taken from the 2015 report “What Lies Behind the Global Trade Slowdown?” by the World Bank (Global Economic Prospects, January) and a report by Taiwan’s Central Bank to the legislature in 2015.

IP Observer: If it is true that many businesses in many industries (such as Hon Hai) have said, that reducing Taiwanese patent applications is a strategic shift in their target market, how will the Taiwan Intellectual Property Office deal with this?

Hong: Once businesses develop a certain level of skill at R&D and patent application strategy, they will, of course, begin to move towards higher quality, in an attempt to bring some real assets to the company through high-quality patents. In recent years, more and more businesses in Taiwan have shifted from a role as original equipment manufacturers to independent brands, and have attempted to market these brands internationally. International patent litigation points to the importance of patent quality. Looking at the application data for Hon Hai Precision Instruments, the company's current application strategy is to clarify the real profit that each of their patents can gain them post grant and to focus on the asset value or monetization of high-quality patents. This means they are not as focused on quantity as they were before.

To create an environment in which businesses are eager to apply for Taiwanese patents, our office has to strengthen measures in the following regards:

- Construction of a better patent system: TIPO has recently made amendments to many aspects of applications procedures, including incentives such as a reduction in renewal fees with e-filing, a statement of priority free of charge and measures aimed at loosening restrictions on foreign language application procedures. We've also amended the patent act, to loosen restrictions on eligibility for the pre-application publication grace period and assertion procedure, as well as those on corrections to patents, and the norms for invalidity examinations and non-obviousness examinations. All of which is aimed at creating a friendly application system.

- Better patent quality: Improving examination quality has been a constant goal for this office. As of October, 2016, the average patent examination duration was just 20.33 months, with the average time until the first office action (OA) at 12.37 months. In addition, training, case discussions and standard operating procedures are in place to ensure an adequate level of quality. In recent years we have also implemented reviews of invention patent examinations, with 350 applications out of the 48,955 completed cases this year up to October being reviewed, which brings the percentage of cases subject to review from the 4.6% last year up to 7.15%. This is higher than the sample sizes of the USPTO at 5% and that of the Japan Patent Office at 1.4%. This has undoubtedly raised patent quality.

- Strengthening accelerated examination procedures: Through acceleration examination mechanisms, such as the accelerated-examination program (AEP) and patent prosecution highways (PPH), we can provide applicants with a quicker channel for obtaining a patent (as of the end of October 2016, the average time for the first office action through the PPH program was 56.8 days, with the average examination period lasting 135.1 days). Taiwanese patents have the advantage of being both good quality and quick to obtain and this is attractive to businesses in that they can take advantage of the efficiency of Taiwanese patent examinations and on this basis apply for patents in other countries. Currently TIPO is a more time-efficient option than China's State Intellectual Property Office (SIPO), and its examination quality has been affirmed by countries including the US, Japan and South Korea. SIPO received 1.1 million invention patent applications in 2015, which is a heavy burden on their efficiency. Applying for patents in Taiwan is cheap and as Taiwan shares a language with China, approved Taiwanese patents can serve as a reference when applying for Chinese patents, another incentive for companies to apply for patents in Taiwan. Of course, in the future TIPO plans to put in place a priority document exchange and a patent prosecution highway arrangement with SIPO, which will enable companies to obtain a patent more quickly and which will serve as more of a pull for applicants.

- Assisting businesses with patent target countries: To assist local companies in raising the value of patents and encourage them to apply for Taiwanese patents, from 2014 onward, our office has held seminars on helping businesses raise the potential value of patents, as well as making use of the professional skills of examiners to provide customized classes on industry trends, such as FinTech, e-commerce, green technology, biotechnology, precision machinery and information systems. These classes involve imparting analysis on the current global patent landscape in that particular field, and offering suggestions for patent application strategies, helping firms to secure valuable patents and suggesting that they use Taiwan as a jumping off point for their global patent application strategy. They can then use the results of the Taiwanese patent examination to evaluate their international moves to allow for the best protection and application of the technology they have developed. The office has held 76 such seminars thus far in 2016.

- Raising the public profile of patents: In order to clear the backlog of patent application cases, this office trained 170 fixed-term contract patent examiners and 200 soldiers taking substitute military service in research and development to examine patent applications. After they finished their contracts, they took their knowledge of the importance of applying for patents back into industry, which has helped to raise awareness of the importance of patent protection for companies. This office also goes through several different channels to promote the advantages of applying for patents in Taiwan among the public.

IP Observer: A company's global patent strategy necessarily changes when the company changes its operating model (like for example as part of the New Southbound Policy, or regional integration initiatives); Has TIPO adopted any measures to complement government policies, to help Taiwanese businesses configure their overseas patent deployment strategy?

Hong: Taiwan has high potential in terms of innovation and R&D, but it really requires more systematic efforts at innovation to increase its competitiveness. As well as our office, there are several other government units bringing measures forward and offering assistance. Below is a list of a few things that still require some attention:

- Helping companies with their global patent deployment: In terms of patent strategy, this office has continued to provide assistance to the Ministry of Science and Technology (MoST), as well as the Department of Industrial Technology and the Bureau of Energy, both under our parent agency the Ministry of Economic Affairs, to provide analysis of the patent landscape, including assisting in analyzing the intellectual property assets of national energy plans and the deployment of these assets. We also provide customized patent seminars for businesses, led by patent examiners, in order to allow businesses to get an understanding of core technologies, in the hope of giving them a competitive edge. TIPO has already completed an analysis of patent applications relating to FinTech, for example, and we will work with the Financial Supervisory Commission of the Executive Yuan in the future in inviting the financial industry to undertake education and training on global patent deployment.

- Launching a critical patent search platform for the communications industry: From 2013 to 2015 this office has been engaged in analysis of communication patent lawsuits and industry trends. In that time we’ve analyzed 8,000 standard essential patents and 13 major international patent litigation cases. This year, we've integrated the knowledge garnered from these three years of research into the building of the communications industry critical patent data search platform, which allows members of the public to research communications industry patent trends and analysis of patent litigation, as well as data on the international patent deployment of major industry players, to aid companies in strengthening their patent strategy management.

- Providing small and medium-sized enterprises (SMEs) with IP data: this office has integrated IP-related policy and advice from government agencies such as the Industrial Development Bureau (IDB), including resources relating to R&D innovation, technology transfer and commercialization, employee training and managing IP disputes, to create the SME IP Zone on the office's official website. This offers firms the information they need on IP and provides resources and a service window that they can access with ease at each stage of their development.

- Strengthening pre-R&D search capabilities: in order to ensure that industry and academic and research institutes are equipped with all the information they need in advance of engaging in R&D, to ensure the most effective use of investment, the patent search center has expanded its services from 2014, and now accepts patent prior art search requests, to help businesses avoid repeating R&D and wasting resources. This also enables applicants to secure a higher quality patent right.

- Cultivating the patent professionals industry requires: the entire intellectual property education system needs to strengthen its understanding and engagement with industry, in order to be able to meet industry demand for high-level talent. This office has continued to engage in patent personnel training and development, to produce the talent that industry requires.

- Push for more PPH agreements: we have raised our examination efficiency and standards, to allow applicants to secure foreign patents quickly and to build their global patent deployment.

Hong: In terms of the FinTech and green energy sector, both being promoted by the current government, our office has done the following:

- The invention and utility model patents that FinTech-related Taiwanese businesses have applied for in the past 10 years (Jan. 1, 2016 - Oct. 25, 2016) are roughly made up of the following: 1,324 administrative or management patents, 502 patents for payment methods, 550 financial insurance patents, 2,081 commerce patents and 2,362 other patents for specialist services such as health care, travel and legal services. Just taking into account FinTech invention and utility model patents in the payments, financial insurance and business categories, they moved from 156 in 2006, to 205 in 2007 and 242 in 2008, this growth was maintained up to the 375 patents in 2015. Among these, applications from the banking sector from January to October, grew to 63, compared to just 9 for the same period last year. This suggests that our office's work in helping industry to build patent portfolios has already seen some success (we've held 7 seminars on this topic in 2016), in line with the government's industry policy.

- In order to address the rapid development of the global green economy, the application of new energy technology has become the major driver of industrial development. This year this office published an analysis on Taiwanese patent trends in the green energy industry, analyzing the period from 2005 to 2015. The patents analyzed span categories such as solar optoelectronics, LED lighting, biofuel, energy information and communication technology (EICT), clean energy (geothermal, wind etc), fuel cells, and lithium-battery powered cars. There have been 33,505 green energy related patents published during this period, Taiwanese applicants account for 15,434 (46%), while foreign applicants account for 18,071 (54%). Although the local applications come out slightly behind the foreign applications, if we just look at the EICT, lithium battery cars and clean energy categories, Taiwanese applications outnumber foreign applications, with 3,483 patents in the EICT category, 22.6% of total green energy patents, with the top three applicants being Hon Hai Precision Instruments, the Industrial Technology Research Institute (ITRI), and Delta Electronics; in the lithium battery car field there were 2,293 patents, occupying 14.9% of the total, with the top three applicants being Hon Hai Precision Instruments, Delta Electronics and ITRI; there were 251 patents in the clean energy category, accounting for 1.7% of the total, with the top three applicants being the ITRI, Hon Hai Precision Instruments and National Pingtung University.

- TIPO is continually monitoring global patent and technology trends. From 2013 intellectual property offices around the world, including the USPTO, have been pushing green energy technology companies to develop long term solutions. As well as introducing accelerated examinations channels, to encourage green energy technology patents, so that they can be applied to industry at an earlier stage, this office has also been working to get domestic companies in line with these international trends, allowing applicants with a green energy technology related patent to qualify for accelerated examination. This means that businesses are able to bring their green energy technology to the global market earlier and get a jump on the competition. As of the end of October, 2016 there have been 111 applications, of which 104 were from domestic applicants and seven were from foreign applicants. As domestic applicants account for the majority of applicants, it suggests that TIPO has been successful in encouraging domestic companies to engage in green energy technology R&D and to apply for patents, in line with the government's industry policy. Currently Taiwanese examination time is similar to that of Japan and the US, and we will continue to offer accelerated examinations for certain prioritized fields.

IP Observer: There seems to be several government agencies responsible for promoting innovation and R&D, and most of these tend to outsource the work (to the ITRI, the Institute for Information Industry (III) or to private management consulting companies). Do you think there is an overlap of resources or some waste going on? Can these efforts be integrated? Does the intellectual property office have any suggestions to improve Taiwan's R&D abilities?

Hong: All of the research and development plans launched by government departments are first reviewed by the agency’s parent ministry, then they are proposed to the Board of Science and Technology of the Executive Yuan for review. Finally they are reviewed for their technical content by a panel of experts invited by the Ministry of Science and Technology, to avoid the problem of overlapping policies and wasted resources. Different government consultative programs are delivered by a range of different government agencies, like the A+ Industrial Innovative R&D Program being led by the Department of Industrial Technology under the Ministry of Economic Affairs, the Industry Upgrade Innovation Platform Guidance program led by the Industrial Development Bureau under the Ministry of Economic Affairs and the Small Business Innovation Research program led by the Small and Medium Enterprise Administration under the Ministry of Economic Affairs. It's sometimes hard for business leaders to understand which is most suitable for them, so every year the Ministry of Economic Affairs holds an explanatory session on the content of each of the programs.

To promote innovation and R&D in Taiwan, I feel that one can start from the following:

- Building a more convenient patent search data environment: TIPO has already launched a technology program involving big data on patents, which takes global patents as the scope of its big data analysis. This will provide domestic industries with what they were previously only able to get from overseas, integrated patent documents from the five biggest patent offices, providing localized, one-stop shop search services for global patent data.

- Strengthening links between research institutes and industry: We are encouraging research institutes to get the most out of their R&D, using core technology to form alliances with related upstream, mid-stream and downstream for joint cooperation. This not only avoids duplication of R&D, it also allows the R&D to be more effectively targeted for industry application.

- We have strengthened predictive analysis, raising patent application quality and ensuring timely applications for important technology to make sure it enjoys patent protection.

- People are the root and the core to innovation and R&D. Taiwan's innovation-oriented education only begins from university level onward. There is a need to go closer to the root and start this education at high school and elementary school level, in order to popularize innovation-centered education. At the same time, education has to increase its understanding of and interaction with industry, in order that schools are cultivating talent with practical skills, as well as providing industry with high-level talent.

IP Observer: Do you have any view on the monetization of patents?

Hong: As well as making use of government resources and mechanisms, one has to be adept at enforcing your patent rights and be able to convert their intangible value into tangible profit, and this may entail a loosening of current regulations or new measures. To monetize high-value patents, the patents you apply for must involve inventions which themselves are of a certain quality, have a market value, are drafted with a certain level of skill and that have undergone a speedy and rigorous examination. Among these, having a well-drafted patent application, particularly in terms of the specification, is very important. It's only if your patent is well-drafted that your invention can really be protected effectively and stand up to infringers, giving the patent value.

For a patent to be commercialized, patent design-around, market valuation, product niches, and the limits of the technology's mass production are all things that need to be worked through. If the patent holder is a company working in industry, they must take steps to plan out the commercialization of the technology while applying for the patent. And if the patent holder is an individual inventor, a school or a research institute, you can work on preparing your invention for technology transfer to industry, to enable its commercialization. Practical steps are as follows:

- In terms of inventors or research institutes, in the early stages of R&D, you can do a prior art search through your intellectual property department or outsource it to the patent search center, to avoid waste in duplication of R&D; After achieving a certain level of results, reach out to industry players in the field in question through your intellectual property department or marketing department to negotiate a cooperation deal or technology transfer. And finally during the patent application and examination process, get a search report to find out useful information for after it is approved, or when you've already been granted the patent you can attend inventors' fairs to raise your profile and to raise the possibility of cooperation or technology transfer with industry.

- TIPO not only holds inventors' fairs every year, to provide opportunities for inventors to network with industry, we have also built an educational and promotional network for patent commercialization to facilitate opportunities for patent holders to network with industry, all in the hope of promoting the market value of patents, so that they can be monetized.

|

|

| Author: |

Conor Stuart |

| Current Post: |

Senior Editor, IP Observer |

| Education: |

MA Taiwanese Literature, National Taiwan University

BA Chinese and Spanish, Leeds University, UK |

| Experience: |

Translator/Editor, Want China Times

Editor, Erenlai Magazine |

|

|

|

| Facebook |

|

Follow the IP Observer on our FB Page |

|

|

|

|

|

|