One of President Tsai Ing-wen’s main platforms in her election was the “New Southbound Policy”, part of her objective to diversify Taiwan’s trade away from China. Given that Taiwan first launched a southbound policy in 1990, however, what is new about this proposal? Is it just seeking a new location to source cheap labor without any real interaction with ASEAN markets? On October 20, the International Trade Bureau of the Ministry of Economic Affairs held a conference to discuss opportunities and challenges in the ASEAN market.

The previous “southbound policy” was launched under the administration of former president Lee Teng-hui and was briefly resurrected under the helm of former president Chen Shui-bian. However, the focus of these policies, was simply to find a cheap manufacturing base with a cheap supply of labor for Taiwanese businesses. The economic rise of China, however, drew many Taiwanese investors to divert their resources to China, where there was no language barrier and less administrative barriers.

Although many Taiwanese businesses are still attracted to ASEAN countries by the promise of cheap labor and cheap costs, Hsu Chun-fang, a consultant for the Chinese National Federation of Industries (ROC), pointed out what distinguishes this policy from what went before (see Table 1).

Item |

Under Previous Policies |

Under This Policy |

New Scope |

The ASEAN 10 (Singapore, Vietnam, Indonesia, the Philippines, Malaysia, Thailand, Cambodia, Brunei, Myanmar and Laos) |

The ASEAN 10, six South Asian countries (India, Sri Lanka, Bangladesh, Nepal, Bhutan, Pakistan), Australia and New Zealand |

New Direction |

- Taiwanese businesses going to ASEAN countries to invest

- Taiwanese people visiting ASEAN countries for tourism

- Students from ASEAN countries coming to study in Taiwan

|

- Welcoming ASEAN and South Asian businesses to invest in Taiwan

- Allowing “white-collar” tourists from the ASEAN region and South Asia to visit Taiwan

- Taiwanese students visiting ASEAN and South Asian countries for summer internships.

|

Basis |

Sees ASEAN countries as a cheap overseas manufacturing base |

Progressive expansion, with ASEAN and South Asia seen as an extension of Taiwan’s internal demand |

Table 1; Source: Hsu Chun-fang’s presentation translated from the original Chinese

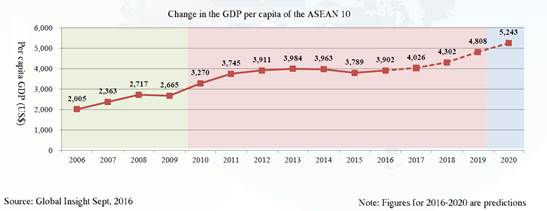

This is largely due to the changing nature of ASEAN and South Asian countries, and the predictions of a continued increase in their purchasing power (see Figure 1), which has framed them as potential markets, in contrast to their previous role as simply a cheap labor force. GDP per capita in the region is expected to break the US$5000 mark by 2020.

Figure 1: Change in the GDP per capita of the ASEAN 10; Source Yang Shu-fei’s presentation

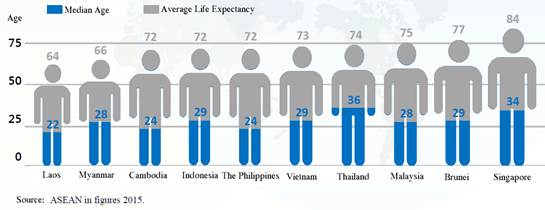

The ASEAN region has a collective population of 620 million people, with a middle class of around 150 million people. The middle class is expected to expand to 400 million people by 2020, according to predictions by Nielson. 53% of this population is under 30 (see Figure 2), suggesting that acceptance of new technology and products will likely be high, according to Chung-hua Institute of Economic Research (CIER) researcher Yang Shu-fei.

.

Figure 2: Median age and average life expectancy for ASEAN 10

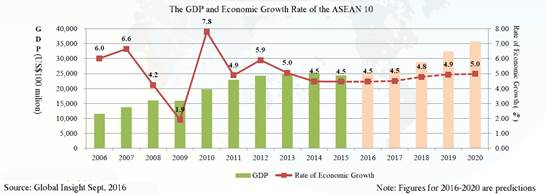

The collective GDP of the ASEAN 10 was US$2.4 trillion in 2015, and this is predicted to rise to over US$7 trillion by 2030, according to a Global Insight report from September cited by Yang (see Figure 3).

Figure 3; Source: Report by CIER researcher Yang Shu-fei

Since 2008, ASEAN has become Taiwan’s second largest export market, second only to China, with 18.2% of Taiwanese exports going to ASEAN, according to Yang, citing customs figures. ASEAN has been the third largest source of imports to Taiwan since the year 2000, second only to China and Japan, with 12.4% of Taiwanese imports originating from ASEAN countries in 2015. Taiwan is also one of the largest investors in ASEAN countries, with cumulative investment of US$86.9 billion in the thirty years up to 2015, making it second only to China.

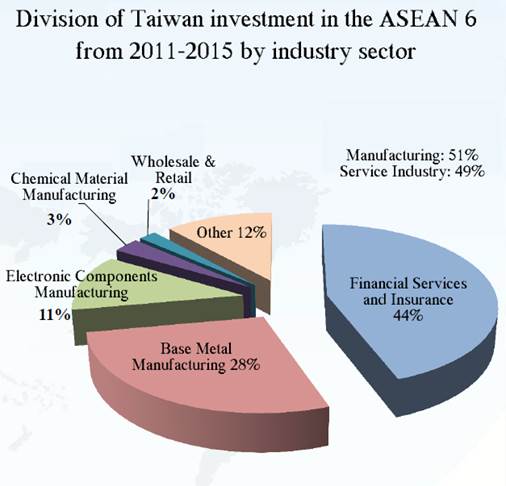

From 2011-2015, 51% of Taiwanese investment in the ASEAN 6 countries (Thailand, Indonesia, Malaysia, the Philippines, Singapore and Vietnam) was in the manufacturing sector, while 49% was in the service sector (See Figure 4).

Figure 4; Source: Investment Commission, Ministry of Economic Affairs

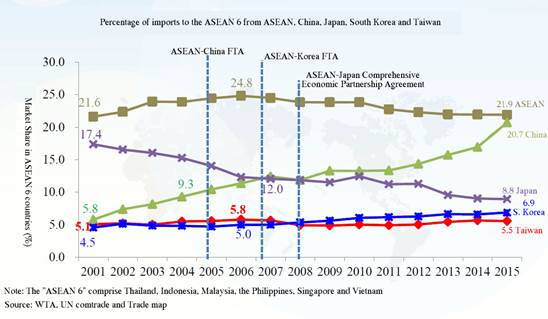

In terms of imports to the ASEAN 6, imports originating from Taiwan make up 5.5% of total imports, behind imports from within ASEAN at 21.9%, imports from China at 20.7%, imports from Japan at 8.9% and imports from South Korea at 5.5% (See Figure 5).

Figure 5: Imports to the ASEAN 6 from within the ASEAN region, China, Japan, South Korea and Taiwan

Yang drew attention to some of the problems that Taiwanese businesses are likely to encounter when trying to do business in ASEAN countries or South Asia (see Table 2)

Item |

Major Obstacles |

Physical Distribution Channels |

1. Lack of large retailers in the local market

2. Negotiating directly with local distributors often results in high costs and is limited by language barriers and lack of brand recognition. (Limitations in physical distribution channels can be overcome by using online distribution). |

Cross-border E-commerce |

1. Marketing/Sales:

1) Lack of trust in e-commerce platforms run by Taiwanese companies; Low rate of sale closure

2) Given the amount of products available on e-commerce platforms, there may be difficulties in developing interest for specific products

3) Language barriers have an effect on customer service, sales and ease of tax filing

2. Logistics:

1) Limited number of logistics companies

2) Speed of logistics

3) High cost of the last mile in logistics services

4) High rate parcel loss or theft

5) Lack of ease in returns; high likelihood of disputes

3. Cash flow

1) Online shoppers prefer to pay on receipt of goods; embezzlement often results |

Tariff and Non-Tariff Barriers |

The tariff and non-tariff barriers in Southeast Asia are high, for example inspection and quarantine (foodstuffs, cosmetics, health foods) and limits on investment, which weaken the competitiveness of Taiwanese products in the absence of an FTA. |

Table 2: Major Obstacles to Doing Business in Southeast Asia

Hsu also put forth some potential problems Taiwanese businesses could run into in the region and her suggestions for the project (see Table 3).

Problems |

Suggestions |

- There are a lot of variables in the market and there are a lot of local competitors who have been in the market longer.

- Potential partner countries have good relations with China.

- There is a certain cost for market access to the infrastructure market.

- There is little incentive for cooperation between think tanks.

- Lack of a serious effort at coordination between different ministries and departments.

- Uncertainty as to how willing Taiwanese businesses are to take part.

- Where will the funding for educational exchange initiatives come from?

- The idea of expanding into new generation markets is yet to be accepted.

- Lack of a systematic plan.

|

- Look back at the shortcomings of the previous southbound policies to avoid retreading old ground.

- Start small and then expand using trial schemes initially.

- Sign economic cooperation agreements (ECA) with partner countries; cross-strait relations are still important.

- Establish a single government window to ease access for companies under Southbound policy, as well as raising government integration and efficiency.

- Actively pursue the signing of bilateral insurance agreements

- Bridge policy objectives

- Increase participation in the infrastructural plans of the Asian Development Bank

- Build a new commercial environment

- As well as the Transpacific Partnership, the Regional Comprehensive Economic Partnership should be taken more seriously.

- The Building Block strategy still needs to be actively pushed forward.

|

Table 3: Problems and suggestions pointed out by Hsu.

Tony Phoo, an analyst from Standard Chartered Bank stated that there's little point of Taiwanese businesses getting involved in trade with ASEAN unless the goods in questions have some link to Taiwan, due to the high tariff entry level.

In attendance at the conference were two poster boys for the New Southbound Policy, CEO of app developer Sunfun Info Lin Chih-ming and Lin Chia-chen, the CEO of tea and beverage chain OCOCO International. Sunfun Info successfully launched the SweetRing dating app in several markets in ASEAN, South Asia and Latin America, while COCO has launched franchises in Thailand and Indonesia, with a total of 2000 stores worldwide.

Sunfun Info avoided some of the physical barriers to entry in the ASEAN and South Asian markets by conducting its business purely online, without setting up offices in the target countries. However, Lin suggested that currently it is too difficult to hire people from ASEAN and South Asian countries who have been studying in Taiwan in order to take advantage of their knowledge of those markets in Taiwan. He described how these kinds of people have played an extremely important role as a bridge for the company to understand the local market, but that Taiwan's government policy currently makes this extremely difficult. Initially they had attempted to launch their app in China, but shifted to the ASEAN market with the rise of rival app developers in China.

Lin Chia-chen emphasized the need to understand the individual countries in Southeast Asia and South Asia and the diversity of culture within single countries. He also pointed to the genetic and linguistic links between the aboriginal people of Taiwan and the Austronesian people of Southeast Asia. He stated that Taiwan has also got to compete with Chinese and Japanese influence in both regions. He also suggested that Taiwan offer some sort of incentive for ASEAN countries to trade with Taiwan.

|

|

| Author: |

Conor Stuart |

| Current Post: |

Senior Editor, IP Observer |

| Education: |

MA Taiwanese Literature, National Taiwan University

BA Chinese and Spanish, Leeds University, UK |

| Experience: |

Translator/Editor, Want China Times

Editor, Erenlai Magazine |

|

|

|

| Facebook |

|

Follow the IP Observer on our FB Page |

|

|

|

|

|

|