There is no question that the Chinese semiconductor industry is getting stronger and stronger. The productivity and technology level of semiconductor vendors throughout the supply chain including equipment manufacturers (ACM Research), IC design houses (HiSilicon, Spreadtrum, Datang Semiconductor Design), wafer manufacturers, foundry and testing firms (SMIC, Nantong Fujitsu Microelectronics) and terminal device manufacturers (Huawei, ZTE) have continued to progress in recent years. However, compared to international giants, Chinese semiconductor vendors are still lagging in many respects, and that’s why they want to team up with Taiwanese semiconductor vendors in the international market.

The 5th Cross-Strait Integrated Circuit Cooperation Seminar was held during SEMICON Taiwan 2016 in early September. At the seminar semiconductor vendors from both sides of the Taiwan Strait gathered to explore opportunities for cooperation. In attendance at the seminar were David Wang, CEO of Shanghai-based ACM Research, James Yang , market director at Shanghai Huali Microelectronics Corp., Kao Hsueh-Wu, GM manufacturing operations at Taiwan’s MediaTek, Shi Lei, GM at Nantong Fujitsu Microelectronics Co. and Chu Lung, president of SEMI China.

Semiconductor vendors attend the Cross-Straits Integrated Circuit Cooperation Seminar.

From left to right: David Wang, James Yang, Chu Lung, Kao Hsueh-Wu, Shi Lei.

Photo courtesy of Anita Li

China: Market Size; Taiwan: Technology Level

The first speaker at the seminar, David Wang with ACM Research, stated that the main reason for cross-strait vendors to cooperate with each other was to “keep profits within the family”, echoing the words of Chinese president Xi Jinping in his meeting with former Taiwanese president Ma Ying-jeou at a summit between the two leaders in November, 2015. China and Taiwan each have their own competitive edge, Wang said, adding, “China wins in terms of market size; but when it comes to manufacturing standards, Taiwan can play with the big boys (with wafer foundry giants TSMC and UMC). Chinese vendors have continued to advance in terms of equipment and materials over recent years.”

Wang believes there is room for Chinese equipment manufacturers to work together with Taiwanese IC makers. He emphasized that the latter are very strong in technology while China has a huge market in IT and consumer electronic products. Driving forces of cooperation include mobile communication, cloud computing, autopilot technology and robot applications, all related to chip manufacturing. The ongoing development of semiconductor technology offers cross-strait semiconductor vendors huge opportunity.

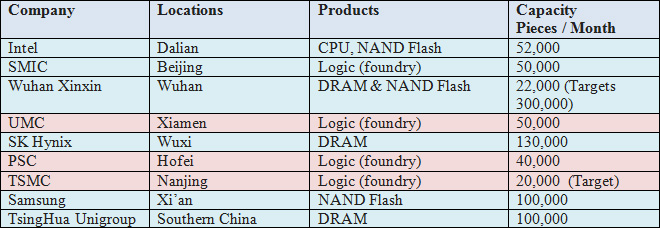

Wang stated, “We need more capacity in the future, and only China can realize this. The growth of the semiconductor manufacturing equipment industry follows the IC manufacturing industry. Nowadays, wafer fabs are concentrated in China, and around ten 300mm wafer fabs will be established in China over the next few years. I believe Chinese equipment manufacturers will be major players in the global market in the near future.”

Table 1. 300mm Wafer Fabs in China (Both existing and under construction)

Source: Various companies, United Daily News

• Pink represents companies with Taiwanese leadership

Wang believes each company has to develop and improve upon its core technology, to enable it to be available on the market as soon as possible. As processing technology keep advancing, equipment manufacturers should keep their technology level 2-3 generations ahead. Equipment manufacturers in China need to take advantage of the opportunity of the technology upgrade and expand their companies. There are three points that Chinese vendors should keep in mind: “Differentiation, market timing and IP.” Wang stated that the last one was especially important, adding, “Even if you have great technology, you can’t do anything without IP.”

IoT – The Main Driving Force of the Semiconductor Industry

Kao Hsueh-Wu at MediaTek believes mobile internet and IoT have the greatest market potential. This is because smartphones are important gateway devices, whether in terms of mobile internet or IoT.

Why should cross-strait vendors work together?

Kao agreed with Wang that Taiwanese vendors are strong in the IC design sector. In addition, since Taiwanese vendors have a lot of experience in the semiconductor industry, they have richer experience in management and planning; while China has abundant capital and a huge applications market. As a result, China can develop its own standards, specifications, services and applications.

Kao believes as Taiwanese wafer fabs continue to expand their capacity in China, it will drive downstream industries, such as IC packaging and testing, to follow suit. “That’s what we call the locomotive effect,” he added.

James Yang, market director at Shanghai Huali Microelectronics, sees two areas on which cross-strait semiconductor vendors can cooperate. The first one is undoubtedly IoT, he said. Yang stated that in terms of cross-industry connections, whether from terminal to terminal or from backbone to terminal, semiconductors plays an important role. The second is “Make in China 2025”. Yang says, “China is a ‘big’ manufacturing country, but not a ‘strong’ manufacturing country.” With guidance from the government in terms of policy, cross-strait vendors will find it easier to move forward “strong manufacturing” instead of just manufacturing that is “large in scale.”

The demand in China’s IC market always surpasses supply. At present, 90% of IC products that are used in China are imported from overseas, with only 10% made domestically. China’s government aims to achieve the goal of 49% of IC products being “made in China” by 2020. Yang stated that this means Chinese fabs will have to achieve a collective target of 700,000 pieces of 300 mm wafer at a capacity of 28 nanometers by 2020. In addition, the country aims to be self-sufficient for 70% of demand by 2025. This means producing 1 million 300 mm wafers. It is obvious that Chinese semiconductor vendors can’t make it happen on their own, and will need help from more experienced Taiwanese vendors to achieve this.

Nantong Fujitsu Microelectronics began working with MediaTek five years ago, making the firm MediaTek’s first IC packaging and testing partner in China. Shi Lei, GM at Nantong Fujitsu Microelectronics indicated that the cross-strait semiconductor sector constitutes more than 70% of the global market in both IC packaging & testing and wafer foundry areas. This suggests that cooperation benefits vendors from both sides of the Taiwan strait.

| Author: |

Anita Li |

| Current Post: |

Chief Editor, NAIP Newsletter |

| Education: |

MA Journalism, China Culture University (Taiwan) |

| Prior Posts: |

Chief Editor, Solid State Technology -Taiwan

Chief Editor, CompuTrade International

Overseas Correspondent, Dempa Shinbun |

|

|

|

| Facebook |

|

Follow the IP Observer on our FB Page |

|

|

|

|

|

|