Back in March, legislator and former head of Taiwan’s Financial Supervisory Committee Tseng Ming-chung, warned that the government and financial institutions should focus their efforts on developing financial technology (FinTech) patents. However, the question of what constitutes a FinTech patent and how far Taiwan is lagging behind its counterparts in its patent deployment remained unaddressed. A recent study by the Taiwan Intellectual Property Office (TIPO), however, may have finally provided some answers to these questions.

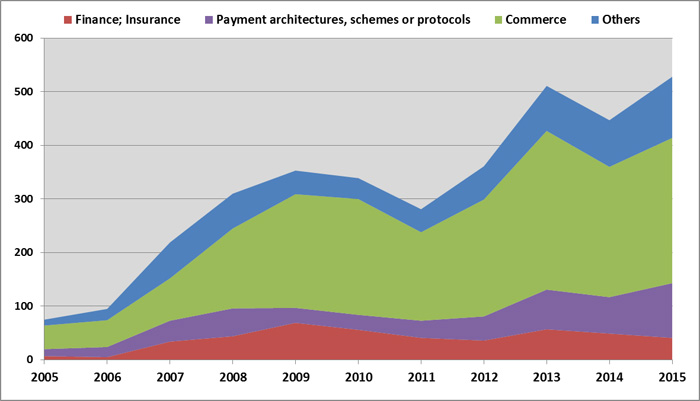

TIPO revealed its own research into FinTech patents for the first time at the end of July. While the study focused on both the global and domestic deployment of FinTech patents, what was most impressive was the trend of Taiwan’s FinTech applications. In last ten years annual FinTech patent applications showed five-fold growth, according to TIPO’s numbers (see Figure 1).

Figure 1: A breakdown of patent IPC code for FinTech patent applications, 2005~2015

Source: https://www.tipo.gov.tw/public/Attachment/67259101946.pdf

We should take these figures with a pinch of salt, however, as TIPO included all applications across categories including Finance and Insurance (IPC G06Q 40/00), Payments (G06Q 20/00) and Commerce (G06Q 30/00). In the breakdown of the above categories, it is clear that commerce makes up half of all applications over the period. Although “purer” Fintech patents—Finance, insurance and payments— saw growth too, they did not constitute a majority of applications.

Nor have major financial institutions focused significant effort on patent deployment. Over the last ten years, there were a total of 3,236 FinTech invention patent applications lodged with TIPO, of which 3,189 were filed by non-financial companies (see Table 1) and of the 801 patents granted, only 12 patents were owned by financial institutions, all of which goes to suggest that the financial industry is not yet a major player in the FinTech sector.

Table 1:Financial/non-financial industry FinTech patent applications and grants, Jan, 2005-Mar, 2016

|

Applications |

Granted |

Financial Industry |

47 |

12 |

Foreign |

14 |

3 |

Local |

33 |

9 |

Non-Financial Industry |

3189 |

789 |

Foreign |

1004 |

292 |

Local |

2185 |

497 |

Total |

3236 |

801 |

Source: https://www.tipo.gov.tw/public/Attachment/67259101946.pdf

Furthermore, among the top eleven (there were two in 10th place) FinTech patent applicants, five were Taiwanese companies: Chunghwa Telecom, P2P lending service provider Shacom, software services provider Mitake Information Corp., the Taiwanese franchise of Japanese convenience store chain FamilyMart, and the owner of the Taiwanese franchise of the 7-11 convenience store chain President Chain Store Corporation. Just two of these can be seen as having businesses directly linked to the financial sector: P2P lender Shacom filed 75 applications, and Mitake Information Corp., which develops software for stock trading, filed 44 applications (see Table 2).

Foreign companies have taken a leading role in FinTech patent applications, however. Chinese third-party payment providers and e-commerce giants Alibaba and Tencent, with extensive experience honed in their home turf, filed 184 and 45 applications respectively. US firms Yahoo! and Microsoft filed 140 and 70 applications respectively, while Japan e-commerce giant Rakuten filed 111 applications, suggesting stiff competition among foreign applicants.

Table 2:Top 10 FinTech Patent applicants, 2005~

|

Assignee |

Applications |

Nationality |

1 |

Alibaba |

184 |

PRC |

2 |

Yahoo! |

140 |

USA |

3 |

Chunghwa Telecom |

117 |

Taiwan |

4 |

Rakuten |

111 |

Japan |

5 |

Shacom |

75 |

Taiwan |

6 |

Microsoft |

70 |

USA |

7 |

Tencent |

45 |

PRC |

8 |

Mitake Inc. |

44 |

Taiwan |

9 |

IBM |

34 |

USA |

10 |

FamilyMart |

27 |

Taiwan |

10 |

PCS Corporation |

27 |

Taiwan |

Source: https://www.tipo.gov.tw/public/Attachment/67259101946.pdf

In sum, Taiwan is still in the infancy of its FinTech patent deployment. If local companies don’t make significant investments in patenting technology in the sector, the business will likely gradually become dominated by foreign companies. What’s more, if banks and insurance companies are to profit from FinTech developments, patent applications should be their priority to allow them to protect their business models. Finally, there needs to be a clearer distinction between “FinTech” and “e-commerce”, and an acknowledgement that FinTech is not just taking the traditional banking model and putting it online. If we see them as identical, then there may be many opportunities that slip by the Taiwanese financial industry.

Reference:

- https://www.tipo.gov.tw/public/Attachment/67259101946.pdf

|

|

| Author: |

Clarence Chiang |

| Current Post: |

Senior Editor, NAIP Newsletter |

| Education: |

Business Administration, National Chengchi University, Taiwan |

| Experience: |

Reporter, CommonWealth Magazine

Reporter, Business Today Magazine |

|

|

|

| Facebook |

|

Follow the IP Observer on our FB Page |

|

|

|

|

|

|