|

Photo Credit / Gil

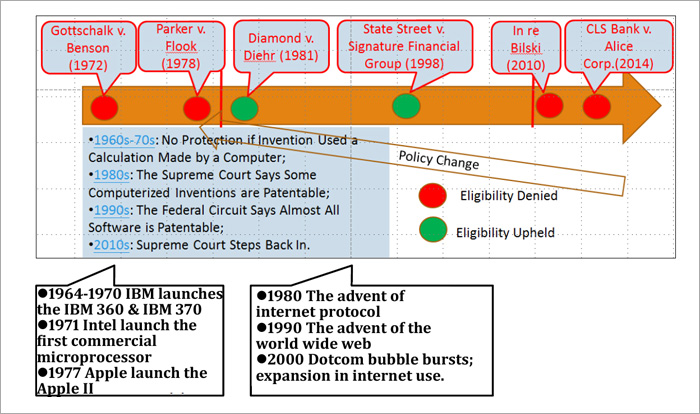

The debate over the controversial 2014 Alice Corp. v. CLS Bank International decision, which marked a return to a stricter standard for patent eligibility in the US seen before Diamond v Dier (See Figure 1), has continued to rage online.

Figure 1: Source: Taiwan Intellectual Property Office, Yan Chun-jen

Despite many people demanding more clarity when it comes to what constitutes abstract subject matter in accordance with section 101 of Title 35 of the United States Code, other patent holders and stakeholders are glad at what they see as a continuing crackdown on frivolous litigation by non-practicing entities (NPEs), more commonly referred to as “patent trolls”. We spoke to Steve Swank, a senior vice-president of patent risk management service provider RPX to discuss how the company helps customers deal with litigation and whether recent court decisions have been effective in suppressing patent trolls.

Steve Swank

- Senior Vice President in Charge of Client Development & Client Relations, RPX

- MBA in Finance, The University of Chicago – Booth School of Business

It is my understanding that your company provides a solution for companies to protect themselves from patent trolls. Is this correct? And can you define what a “patent troll” is and does?

Steve Swank: That’s correct. RPX provides patent risk solutions to corporations, and our solutions are primarily (though not exclusively) designed to reduce the threat of patent infringement litigation from patent trolls, which are also called non-practicing entities, or NPEs.

Last year alone more than 2,500 companies were sued in the United States and the total cost was nearly US$8 billion.

The definition of a patent troll is fairly simple. Patent trolls don’t make products or services. They buy patents (either ownership rights, or exclusive rights to enforce) or license patents from third parties (in rare instances the troll will actually be the inventor), identify companies that they believe are infringing those patents, and then demand a license payment. Usually they file a lawsuit to force the companies to pay. The majority of these lawsuits settle before reaching a final judgment, with the defendant company agreeing to pay for a license.

Patent troll attacks are a large and expensive problem for businesses. Last year alone more than 2,500 companies were sued in the United States (some of them more than 20 times) and the total cost – legal expenses plus settlements – was nearly US$8 billion.

Patent troll attacks usually take the form of campaigns that are built around a single patent or portfolio of patents. Their campaigns usually have multiple target licensees/defendants because patented digital technologies are often complex and could be “infringed” by many different developers or users of the technology.

In many campaigns, each targeted company first receives a letter asserting that the company is infringing the patent and that the company should pay for a license. Often, the company refuses the demand and the troll launches a litigation to force payment. Many of these litigations end with the defendants paying the trolls. This is often not an admission of guilt, but a simple economic reality that it is cheaper to settle than to continue fighting an expensive lawsuit with an uncertain outcome.

Please give an example of your solution and a typical situation/client.

Steve Swank: RPX provides two primary solutions for its nearly 300 clients that face this kind of patent risk: a risk-sharing network of companies and 2) a risk-transferring insurance policy.

Members of our client network pay an annual fee that is based on their NPE risk. Together, this capital is used to acquire patents that represent risk to the members of our network. Not all patents are problematic for all our clients, so we buy a broad cross-section of patents to ensure each member is receiving demonstrable risk reduction.

Our model is designed to preempt risk and prevent litigation whenever possible. As the leading buyer in the market, we are able to analyze and assess which patents could be used by patent trolls to attack our clients. By acquiring these patents before they fall into NPE hands, we stop attacks before they begin. Typically, every patent we acquire is licensed to every member of the network, so the value and the cost of clearing these patents are shared by a large group of at-risk companies.

Of course, not every patent is made available in the pre-litigation market and NPEs continue to own many potentially problematic patents and launch campaigns targeting our clients. Importantly, RPX is still able to reduce risk for our clients even when this happens by intervening early in the lawsuit to negotiate licenses and secure quick dismissals for our clients before the legal expenses begin to skyrocket. The costs of the licenses are shared by the whole network – a far more efficient resolution than if each defendant company had to stay in the suit and fight its way to a settlement individually.

This risk-sharing network model has been very effective. In eight years, we have invested more than US$2 billion to acquire and clear more than 15,500 US and international patents and assets, achieving more than 1,000 dismissals and helping our clients save more than US$3.2 billion in avoided legal fees and inflated license settlements.

Where the network is an ideal solution for companies with relatively high and consistent levels of NPE litigation, it does not always make economic sense for small and medium-sized companies just starting to experience regular troll attacks (or for companies in technology sectors with less frequent troll activity).

For these less frequently targeted companies an insurance policy is a more logical way to mitigate risk. An NPE attack can be financially devastating – a single litigation can last years and easily cost hundreds of thousands (if not millions) of dollars to resolve. Companies with this kind of risk profile can use RPX insurance to be assured they aren’t exposed to the costs of an unexpected litigation.

Where is your company based? Are you active in Asia? If not, will you be extending your business to cover non-US patents?

RPX Corporation is based in San Francisco, California. Currently, we have nearly 300 clients from around the world, primarily in business sectors with exposure to technology patent claims. Almost every company in existence in the 21st Century has exposure because a claim of patent infringement can be leveled against any company that makes, sells, or uses technology. So to be at-risk, a company only needs to have a website or an e-commerce capability or a mobile workforce or use touch screens in customer interactions or leverage GPS-enabled services… really, any digital product, service or function. The risk is that broad.

To date, patent trolls have focused most – but not all – of their attention on larger and more active makers and users of technology, so RPX’s client base largely comprises sectors such as semiconductors, consumer electronics, software and telecommunications. In recent years, patent trolls have begun targeting corollary sectors that increasingly deploy services and products incorporating advanced digital technology – sectors such as financial services and automotive. As a result, our client base has been expanding to include companies in several new industries.

Any company that operates in the United States is subject to US intellectual property laws, so many of our clients are headquartered in Asia and use our services to provide patent risk mitigation for their domestic operations. Most other countries have different patent licensing regimes and laws; for whatever reason, there has not yet been a great deal of patent troll activity outside the United States.

That said, some trolls have begun using the threat of European lawsuits and trade injunctions as a way of exerting pressure when demanding a patent license from an unresponsive company. RPX is closely monitoring these trends, as well as the steadily evolving IP laws and patent litigation developments in China and other Asian countries. It may come to pass that patent trolls will become more active in non-US markets and courts, but today NPE litigation is a problem almost exclusively in the United States.

What recent changes in law or regulation have affected how patent trolls execute their business model?

The US laws affecting patent infringement assertions and litigation have changed many times throughout history. Most of the recent changes, as well as those that are currently being proposed, are aimed at combating troll behavior. But none of them has totally “fixed” the problem, and there likely won’t be any dramatic changes that outlaw the NPE business model altogether. Patents are protected assets under American law (in fact, they are inspired by our Constitution), and property rights are sacrosanct in our legal tradition. Legislatures and courts are likely to preserve those rights, even if it means tolerating some bad behavior.

One of the things trolls typically do is exploit lower-quality patents – those that are vague, broadly written, and based on older technology – in order to confuse their targets and expand the list of licensees. However, the US government has taken steps to make it more difficult – or at least more financially risky – for trolls to monetize lower-quality patents.

One of the most noteworthy developments in the effort to remove these kinds of low-quality patents from the ecosystem was the 2014 Supreme Court decision in Alice Corp vs CLS Bank International. In this ruling the Court gave lower courts and the USPTO guidance to be more rigorous in assessing the validity of patents. Simply put, the new standard holds that a mere idea is not a patentable invention, and merely performing that idea on a computer or device isn’t enough to make it patentable. This decision particularly affects patents on software, and it applies even to patents that were already granted. As a result, there are quite a few patents in circulation that can no longer be successfully asserted or licensed because they will not survive judicial scrutiny.

The US Congress also created a new streamlined procedure for challenging low-quality patents. This is called inter partes review (IPR). By filing a petition for IPR, a company can seek a formal ruling from the US Patent Trial and Appeal Board on the validity of some or all of the claims in a particular patent. This procedure can be used by any company, whether or not they are in litigation. In fact, RPX has filed petitions for IPR against some patents.

Like the Alice standards, the IPR process has helped clear weak patents from the market and made life more challenging for patent trolls. That said, they have not been enough to solve the overall problem. By RPX’s estimate, IPR has affected about 16% of the thousands of patents being monetized in NPE campaigns. And because low-quality patents generally don’t generate long court battles or large settlements, they likely represent a relatively small percentage of the billions of dollars that companies spend every year fighting and settling patent troll litigation.

Have there been shifts in the kinds of patents being asserted and sectors being targeted? Has it changed your acquisition strategy?

Patent trolls are opportunistic and they do invest in patents and industry sectors where they believe they can generate the most attractive returns. As described above, there are certain core sectors where they are active, and they are expanding into related markets. Once an NPE has successfully litigated a patent or portfolio and established its licensability, it will look for other ways to monetize that proven asset.

This makes sense. Technologies logically spread into new industries and applications where they can be exploited for greater efficiency, productivity, or competitive advantage with customers. And technologies also steadily converge – a typical smartphone today provides a dizzying array of features, from telephony to photography to news, entertainment, health maintenance, commerce, and more. There could easily be thousands of patents reading on those technologies. That is a goldmine of opportunity for patent trolls.

Our acquisition strategy is driven by these trends and we are always looking ahead to see where NPEs are focusing their efforts. As mentioned, there has been growing activity in automotive and financial services sectors. We are also watching other emerging sectors where proven digital technologies are being put to new uses, including the Internet of Things and medical diagnostic, imaging, and drug delivery technologies.

Are patent holders in Asia more vulnerable in the US market?

No. All companies face the same risk, regardless of where they are domiciled. A company operating in the United States doesn’t even need to own patents to be at risk of a patent infringement lawsuit. If you make, sell, or use patentable technology in the US market, you are at risk.

How will your business evolve over the next twenty years?

RPX has always believed that a more rational patent ecosystem – with patent value being exchanged based on natural market pricing, rather than the distorted costs of litigation – could be possible if a critical mass of patent owners and technology users joined together in a single clearinghouse system. Like any clearinghouse, such a system would rely on a central manager to receive assets, value them, assign licenses, and deliver payments. And it would require trust from all the participants that valuations are correct and based on objective price and cost data.

The RPX risk-sharing network has many of the attributes of such a clearinghouse and we believe our member network can ultimately evolve into a centralized, rationalizing entity to facilitate the exchange of patent values. We will continue to expand the number of participating companies, but the foundation of cost data, transactional expertise, and trust are already in place. With each patent we license for patent users and each payment we make to patent owners, we move one step closer to establishing a de facto clearinghouse that eliminates the waste and risk of litigation in favor of predictable, affordable license subscriptions—hopefully, sooner than in 20 years.

|

|

| Author: |

Conor Stuart |

| Current Post: |

Senior Editor, IP Observer |

| Education: |

MA Taiwanese Literature, National Taiwan University

BA Chinese and Spanish, Leeds University, UK |

| Experience: |

Translator/Editor, Want China Times

Editor, Erenlai Magazine |

|

|

|

| Facebook |

|

Follow the IP Observer on our FB Page |

|

|

|

|

|

|