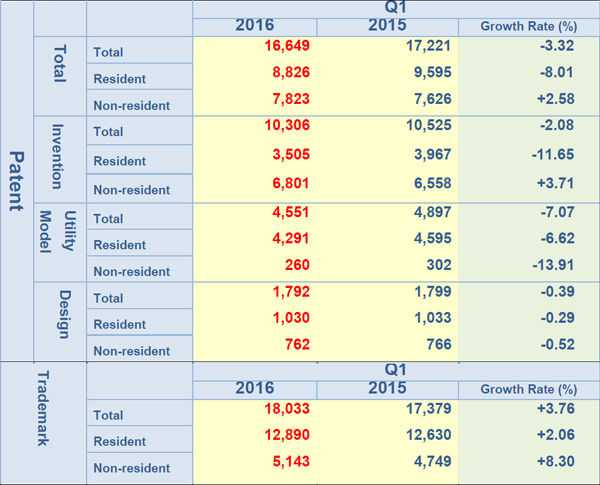

The Taiwan Intellectual Property Office released figures for patent and trademark applications for the first quarter of 2016 last month. New applications for invention, utility model and design patents all saw a decrease, down by 3.32% year on year in total, suggesting local companies in particular are adopting more conservative and selective patent strategies. Non-resident applications saw a growth rate of 2.58%, however, largely due to a 3.71% increase in invention patent applications by non-residents (see Table 1), despite a drop of 11.65% in invention patent applications by residents.

Table 1: Patent and Trademark Applications—Residents and Non-Residents

Source: Taiwan Intellectual Property Office

Trademark applications saw growth of 3.76% year on year, with an uptick of 8.3% in non-resident applications and a rise of 2.06% in resident applications, pushing the total to 18,033.

Table 2: Patent Grants—Residents and Non-Residents

Source: Taiwan Intellectual Property Office

There was slight growth of 0.37% year on year of overall patent grants, bolstered by a 10.28% rise in patents granted to non-residents and despite a 6.34% decline in patents granted to residents. The same pattern was seen with invention patent grants, as the 4.36% year on year increase was largely due to a 10.82% rise in invention patent grants to non-residents, despite a 3.48% fall in invention patents granted to residents. Utility model patent grants fell by 11.93% year on year, with a decrease seen in grants to both residents and non-residents, while design patent grants have risen by 10.55% year on year, with a 19.3% uptick in grants to non-residents, compared to a 3.7% rise in grants to residents.

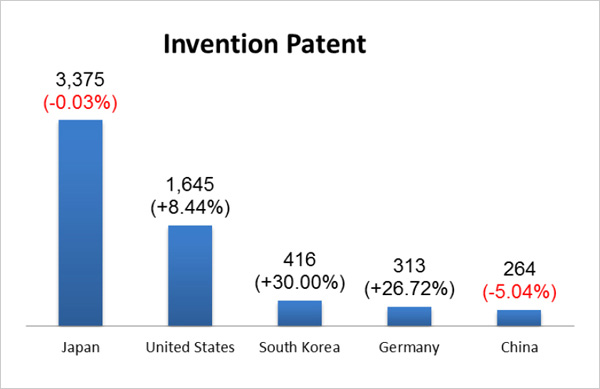

Figure 1: Top 5 foreign countries by number of invention patent applications

Source: Taiwan Intellectual Property Office

Japan retained the top spot in foreign applications for invention patents, although applications from the country were down slightly year on year. Applications from China were also down 5.04%, but the other three countries in the top five, the US, South Korea and Germany saw respective year and year growth of 8.44%, 30% and 26.72%.

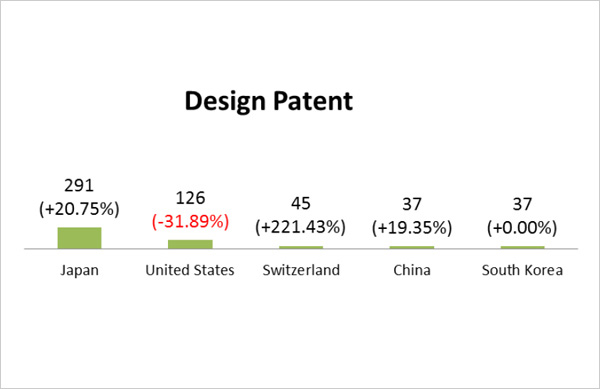

Figure 2: Top 5 foreign countries by number of design patent applications

Source: Taiwan Intellectual Property Office

The number of applications for design patents by Japanese, Swiss and Chinese applicants saw respective year on year increases of 20.75%, 221.43% and 19.35%, while applications from South Korean applicants stayed level and applications by US applicants fell by 31.89%.

Figure 3: Top 5 foreign countries by number of trademark applications

Source: Taiwan Intellectual Property Office

Applications for trademarks by the top 5 - China, the United States, Japan, Hong Kong and South Korea - saw increases across the board, with a substantial 31.05% year on year surge in Chinese applicants to a total of 1,110, which is just under a tenth of the figure for trademark applications by Taiwanese applicants.

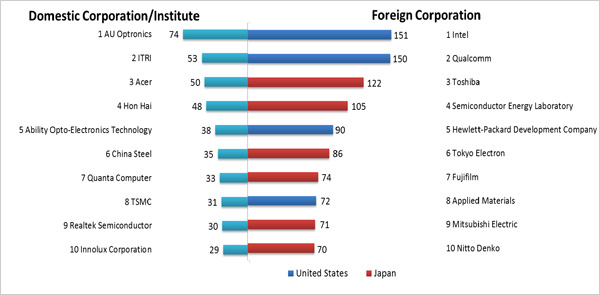

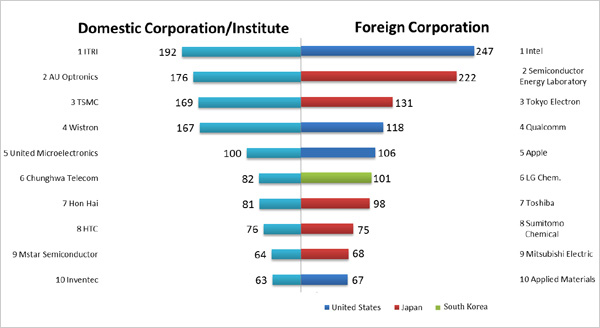

Figure 4: Top 10 domestic and foreign applicants for invention patents

Source: Taiwan Intellectual Property Office

The top ten list of foreign applicants for invention patents was completely dominated by US and Japanese firms. The top two firms were US semiconductor chipmaker Intel, filing 151 applications, followed closely by rival Qualcomm with 150. Both of these companies were recently named by LexInnova as the top Internet of Things patent holders. They were followed in the ranking by Japanese semiconductor firm Toshiba and fellow Japanese firm Semiconductor Energy Laboratory. The list was rounded out by Hewlett-Packard Development Company (US), Tokyo Electron (Japan), Fujifilm (Japan), Applied Materials (US), Mitsubishi Electric (Japan) and Nitto Denko (Japan). AU Optronics topped the domestic corporation/institute invention patent applicant list with 74 applications, followed by the non-profit Industrial Technology Research Institute and hardware and electronics firm Acer. The figures seem to indicate a continuing trend from 2015, in which Intel also topped invention patent filings at 956. In line with the 2015 figures, the semiconductor industry again appears to have dominated the list for Q1 2016, as seven out of the top ten are either semiconductor producers or have semiconductor divisions.

Figure 5: Top 10 corporations/institutes granted invention patents

Source: Taiwan Intellectual Property Office

Intel also topped the list of patents granted to foreign corporations in the quarter with 247, suggesting a sustained patent deployment in Taiwan, while Qualcomm was in fourth place with 118. The number two and three spots were occupied by Semiconductor Energy Laboratory and Tokyo Electron respectively and the list was rounded out by Apple (US), LG Chem (South Korea), Toshiba, Sumitomo Chemical (Japan), Mitsubishi Electric (Japan) and Applied Materials. In terms of grants to domestic applicants, the Industrial Technology Research Institute took the top spot, followed by AU Optronics and Taiwan Semiconductor Manufacturing Company.

|

|

| Author: |

Conor Stuart |

| Current Post: |

Senior Editor, IP Observer |

| Education: |

MA Taiwanese Literature, National Taiwan University

BA Chinese and Spanish, Leeds University, UK |

| Experience: |

Translator/Editor, Want China Times

Editor, Erenlai Magazine |

|

|

|

| Facebook |

|

Follow the IP Observer on our FB Page |

|

|

|

|

|

|