|

In order to cope with the “net zero emissions by 2050” global trend, the Government of Taiwan has clearly declared to actively develop her electric vehicle related industry and to list "Next-Generation Vehicle " as one of the island's key industry. Though Taiwan is not a key player in automotive industry that apply traditional fuels (diesel or gasoline), it is absolutely capable of taking lead in the next - generation automotive industry. The key to succeed is to transform smartly.

Source : shutterstock、TPG Images

Current Production and Sales Status of the Taiwanese Automobile Industry

According to the statistic of Taiwan Transportation Vehicle Manufacturers Association (hereinafter referred to as TTVMA), the production value of Taiwan's vehicle industry keeps growing, and reached NT$770.3 billion from January to November 2023, accounting for approximately 4.8% of Taiwan's total manufacturing output value. Although declined by 9.17% while comparing with the same period last year, it is still an extremely important industry of the island. The scope of vehicle industry covers the automobile industry, motorcycle industry, bicycle industry, and auto parts industry. Among all sectors, the automobile and auto parts industry grew by 11.84% and 1.26% respectively, and their production values from January to November 2023 reached NT$210.4 billion and NT$279.5 billion respectively.

● The production and sales of automobile parts

The upstream of the automotive industry is mainly the production of spare parts, which covers a wide range of processes, including casting, pressing, forging, mechanical processing and heat treatment. Products including car lamps, tires, brass, aluminum alloy steel circles, engine cover, safety lever, etc.

In addition, auto parts are divided into "genuine original parts" and "after-sales spare parts", "genuine original parts " are further divided into OEM and ODM format. Taiwan manufacturers used to focuses on OEM business, but in recent years, it has been actively improving its R&D and design capabilities, and moving towards ODM production for international car manufacturers, which is expected to save mold development costs and improve its bargaining power in the supply chain. "After-sales spare parts" are divided into OES (Original Equipment Suppliers) and AM (Aftermarket Suppliers), Taiwan's parts manufacturers mostly focus on the automotive aftermarket.

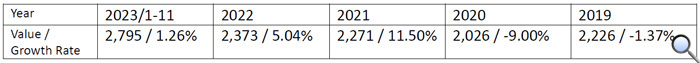

Figure 1. Production value and growth rate of Taiwan’s auto parts industry in last five years (2019-2023) Unit: NT$100 million

Source: Taiwan Ministry of Economic Affairs’ online statistical information inquiry system, compiled by TTVMA

(PS: Automobile parts and components do not include automotive electronics). Figure 1 is the statistics of Taiwan's auto parts production value in last five years, it shows that since the end of the customs lockdown in 2021 and the beginning of the post-epidemic era, the production value of auto parts keeps growing every year. Since only 11 months were counted in 2023, the final annual growth should be higher. However, the overall growth rate is limited, one of the possible reason is that Taiwanese vendors keep increasing their overseas production proportion.

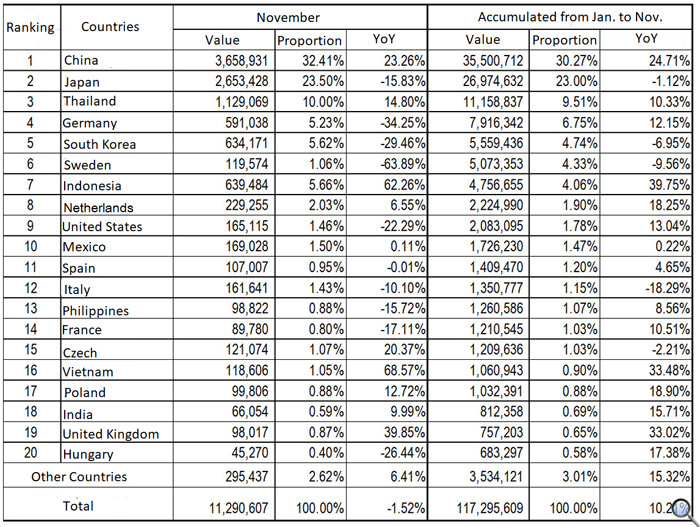

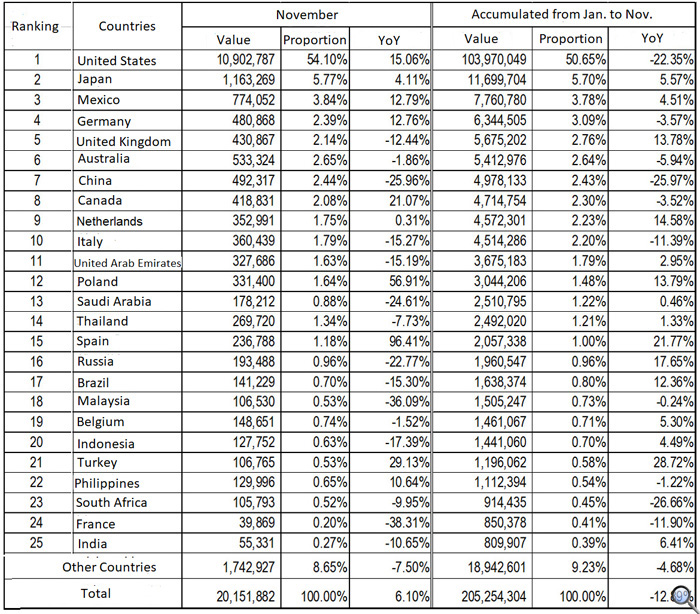

Regarding the auto parts industry, one thing worth observing is its import and export value. As can be seen from Figures 2 and 3, the import value of Taiwan's component from January to November 2023 was approximately NT$117.3 billion, and export value of the same period was approximately NT$205.3 billion, indicating that the competitiveness of the industry is quite strong. However, the value of export decreased by nearly 13% while comparing with the same period of last year, with the export value of the United States and China declining the most. This is also due to the impact of geopolitical influences on Taiwanese vendors setting up factories overseas.

Figure 2. Country-by-country statistics of Taiwan’s auto parts import value in 2023Unit: NT$ thousand

Source: Taiwan Customs import and export statistics, compiled by TTVMA Figure 3. Country-by-country statistics of Taiwan’s auto parts export value in 2023Unit: NT$ thousand

Source: Taiwan Customs import and export statistics, compiled by TTVMA ● Vehicle assembly, sales, import and export

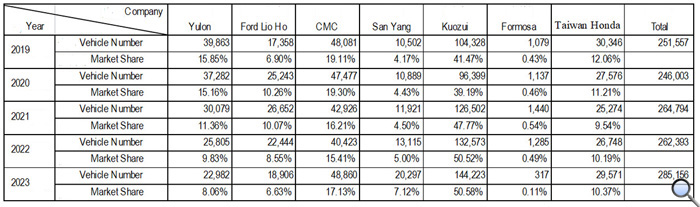

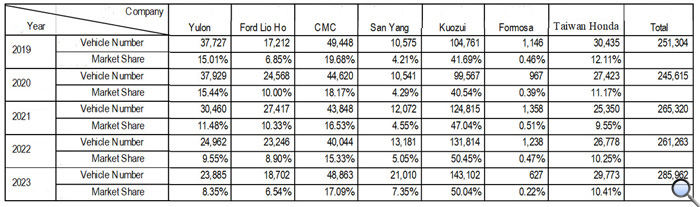

Figures 4 and 5 show the production and sales statistics of Taiwan’s domestically produced automobiles in last five years. During the past five years (2019 to 2023), there were seven active automobile manufacturers and sellers in Taiwan, namely Yulon Motor, Ford Lio Ho, China Motor Corporation (CMC), Sanyang Motor, Kuozui Motors, Formosa Automobile Corporation and Honda Taiwan; among them, Kuozui Motors, which was founded by Hino Motors and Hotai Motor in 1984, has the highest local market share and sold a total of 144,223 units in local Taiwan in 2023, reaching 50.58% accounts for more than half of the market. It is worth mentioning that Kuozui Motors and CMC are currently the only two manufacturers that export automobiles. The former exported a total of 41,417 units in 2023, accounting for 97% of the year’s export value; the latter exported a total of 703 units, accounted for 3%.

Figure 4. Domestic sales volume of local made automobiles in last five years (2019-2023)(Unit)

Source: Sales statistics based on the monthly reports of Taiwan local automotive manufacturers, TTVMA Figure 5. Domestic automobile production volume in last five years (2019-2023)(Unit)

Source: Sales statistics based on the monthly reports of Taiwan local automotive manufacturers, TTVMA Overall speaking, the sales volume of Taiwan's domestically produced cars and imported cars is almost the same, though the former is higher, the gap is very small. The sales volume of domestic car has been declining from 81.37% local share in 2008 to 51.78% in 2023, the difference of market share while comparing with imported cars is now less than 4%. Market analysts believe this should be attributed to the fact that imported car manufacturers have increased their competitiveness due to factors such as reduced goods taxes and tariffs after Taiwan joining the WTO. However, the cost of imported auto parts has not been reduced accordingly. When the tariff on imported complete vehicles and parts are both 17.5%, the production cost of domestic cars is relatively high, causing the price gap between imported cars and domestic cars getting closer and closer, and more consumers switched their choices to imported cars, thus, resulted in the growth of consumption of imported cars.

Unable to be independent in technology and lack of own brand

Many car manufacturers in Taiwan have technical cooperation parent factories. They sign technical cooperation agreements with foreign car manufacturers before producing in Taiwan. For example, Yulon Motors' main technical cooperation partner is Nissan Motors of Japan. The Nissan cars that sold by Yulon Motors are designed by Nissan’s technical plant in Japan and manufactured by Yulon in Taiwan. Yulon Motors is sales company of domestic automobile brand. Hotai Motors is the agent dealer of Japan's Toyota in Taiwan, China Motors has signed a technical cooperation contract with Mitsubishi, and Sanyang Motor has technical cooperation with South Korea's Hyundai Motor, Kuozui Motors cooperates with Japan's Toyota...etc.

Strictly speaking, Taiwan's automobile manufacturing industry does not have its own brands, and LUXGEN is the one that closest to success. However, since the death of LUXGEN’s founder at the end of 2018, LUXGEN’s brand awareness and influence have declined along with sales. In 2022, Yulon Group and Hon Hai Group announced the signing of a cooperation agreement, combining the complementary advantages of both parties’ resources in vehicle R & D and ICT industry resources to form a joint management team. The foundation of the team based on the technology team of HAITEC Automotive Company, targeting at building an alliance to promote vehicle R&D and design, open platform sharing and ecosystem, and strives to win target customers in the global market through the new joint venture company, thus injecting new R&D energy into its own brand LUXGEN.

According to statistics compiled by the TTVMA, LUXGEN sold only 2,321 units in 2023, including 783 units of LUXGEN C71 (U6) and 1,538 units of LUXGEN URX L71; the current main models are the URX SUV series and the newly released model n7 that cooperated with Hon Hai Cooperate. Looking back on the past, since 2009, the total sales volume of the LUXGEN brand in Taiwan has exceeded 120,000 units, and the total sales volume licensed and listed in mainland China is nearly 230,000 units. We believe that the demise of the brand is highly related to the death of the founder, but government policies are also a key factor. If Taiwan's automobile industry wants to develop its own brand, LUXGEN is definitely qualified to be a leader. Whether it can turn around by riding on the wave of energy-saving, carbon reduction and smartness depends on whether the relevant policy-making departments are smart enough or not.

"Smart" is the key for next generation vehicle to be succeeded

Department of Investment Promotion under Taiwan's Ministry of Economic Affairs (MOEA) has released the " Key Innovative Industries in Taiwan: New Generation Automobiles” guidebook in last November. In continuing with successful results of the smart electric vehicle development strategy and action plan, and the smart electric vehicle industry guidance and promotion plan, the guidebook clearly states at the beginning that the next generation vehicles in the guidebook refer to electric vehicles (EV). Content of the guidebook details Taiwan's electric vehicle industry overview, investment opportunities, business opportunities, Investment incentives, representative Taiwanese companies, and foreign investment case studies. The guidebook shows that Taiwan's electric vehicle industry chain is complete and very competitive. While coupling with the government's auxiliary policies and incentives, Taiwan's automobile industry can definitely be pushed to an unprecedented new high.

However, I personally believe that the government's automobile industry (or to be more precise, the electric vehicle industry) policy has room for improvement. It can be seen from the guidebook that the government's policy focuses on electrification but lacks "wisdom". The "wisdom" mentioned here stands for smart, which refers to "smart cars" and "smart cockpits". Taking into account the situation in reality, to develop electric vehicles at this moment, Taiwanese manufacturers are not able to compete with Tesla and BMW in the high-end market; and are difficult to surpass the mainland Chinese manufacturers in the mid- and low-end markets. It is because the China manufacturers are not only occupying the market, they also dominate the specifications to certain extent. However, in the needs of the next generation cars, "wisdom" is a must. "Smartness" has no specifications and is mainly about user experience, so it has a lot of room for development.

One thing is for sure that the next generation vehicle will reshuffle the traditional gasoline/diesel automobile industry. However, Taiwanese manufacturers are a bit late to the market, If they want to be one of the key players in the international market, their products should be “smarter” in order to capture the end-users.

References:

- Industry Value Chain Information Platform, "Automotive Industry Chain Overview"; Securities Exchange, Taiwan Stock Exchange

- Production and Sales Statistics/Automobile related statistics; Taiwan Region Vehicle Industry Association

- " Key Innovative Industries in Taiwan: New Generation Automobiles”; Department of Investment Promotion, Taiwan's Ministry of Economic Affairs

| Author: |

Anita Li |

| Current Post: |

Chief Editor, NAIPnews |

| Education: |

MA Journalism, China Culture University (Taiwan) |

| Experience: |

Chief Editor, Solid State Technology -Taiwan

Chief Editor, CompuTrade International

Overseas Correspondent, Dempa Shimbun |

|

|

|

| Facebook |

|

Follow the IP Observer on our FB Page |

|

|

|

|

|

|